Almost a year has passed since Russia started its illegal invasion of Ukraine, killing tens of thousands and driving millions out of their homes. The military buildup that led to the invasion, and the ongoing costs of that invasion, are being paid for by revenue from fossil fuel exports.

Until late 2022, it seemed that Russia was winning its gambit of weaponizing Europe’s fossil fuel reliance. The country’s successful manipulation of gas, oil and coal markets led to record-high prices, export revenue and tax income from fossil fuel exports.

Europe’s deep dependence on fossil fuel imports from Russia also lulled Putin into a sense of security that the EU’s response to any atrocity from Russia would be lukewarm. Fortunately, the EU, including Italy, proved him wrong. With the bans on coal imports and crude oil imports already in force, gas imports having collapsed due to Russia’s decisions to cut off the pipelines, and the ban on refined oil about to take effect on February 5, most of our dependence on Russian fossil fuels has been eliminated in less than 12 months.

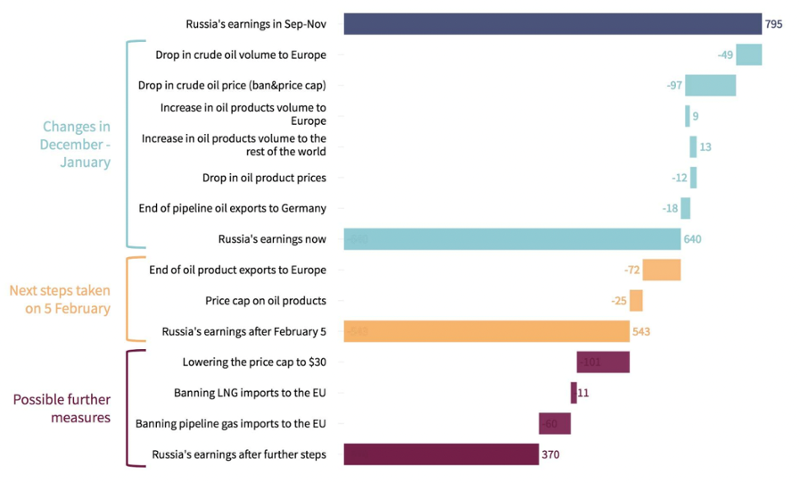

This has not come easy. Instead of coordinated energy saving efforts, we relied largely on high prices to drive down demand, often at major economic and social cost. The faster we can boost clean energy investments, energy efficiency and electrification, the faster these economic and social vulnerabilities can be eliminated. We estimate that the ban on crude oil imports into the EU and the price cap on crude oil are costing Russia $160 mln per day. Oil export volumes collapsed initially when the ban started, forcing Russian exporters to cut prices. Volumes have now recovered, avoiding a negative impact on global supply, but selling prices have remained around $50 per barrel, below the price cap level of $60 and below the price level before the measures of $65–70. A significant further impact is expected when the imports of refined oil products into Europe are banned as well, and a price cap applied on them.

Russia’s expected earnings from fossil fuels (million euros per day)

Source: CREA

The Russian government is more dependent than ever on fossil fuel export income as the costs of the invasion rise and sanctions bite. The government already recorded a budget deficit equal to 2% of GDP in 2022, as revenue from income, sales and corporate taxes plunged. Now as fossil fuel income falls, the government will have to increase taxes or sell its foreign currency holdings to finance the deficit; either option could lead to a vicious circle..

The price cap policy works by capping the price of oil carried on tankers that are owned or insured in the EU or G7 countries. These tankers transport about 60% of oil exported by sea from Russia, making the policy effective.

The level of the price cap was initially set at $60 per barrel of crude oil, a level far above production costs in Russia, as countries were worried that a lower level would prompt Russia to cut supply. At this level, Russia continues to earn billions of euros per month on oil carried aboard European-owned and -insured tankers. Most of the revenue from oil exports goes into state coffers; the government only leaves an average of $15 per barrel to oil producers after taxes. This means that at the cap level of $60 per barrel, the Russian state can still extract $45 per barrel in tax

Revising down the price cap to around $30 per barrel would decimate the tax revenue that Russia uses to sustain its aggression against Ukraine and help end the war faster. The fears that Russia would stop selling oil due to the price caps have proven unfounded so far, as seaborne export volumes have quickly rebounded after the introduction of the price cap. The tax levels are set for every month, after-the-fact, to extract maximum tax revenue while leaving just enough for the producers to cover costs. This means that a lower oil price cap level would translate into lower tax earnings while production could be maintained.

There are other ways to increase pressure on Russia: Italy continues to import Russian LNG, and imports refined oil products from Turkey, Egypt and India, which have become major importers of Russian crude oil. Outside of the sanctions policies, it’s essential for European countries to work to reduce fossil fuel demand. This will enable us to end the current energy crisis for good and make us more resilient against blackmail by oil and gas exporters. We need to accelerate the energy transition, in particular by replacing gas use in buildings with energy efficiency and electricity and accelerating clean energy buildup.