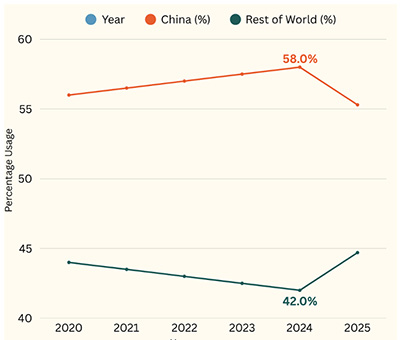

We all know the story: coal is dying, clean energy is thriving, and the future is wind turbines and solar panels as far as the eye can see. But someone forgot to send China the memo. In 2024, China consumed over 58% of the world’s coal— almost 40% more than the rest of the planet combined. That same year, its coal-fired power plants generated a staggering 5.828 TWh of electricity—far exceeded the entire electricity generation of the EU‑27, estimated at around 2,770 TWh from all sources.

China’s Coal Consumption (% of Global Coal Use)

Source: © OECD/IEA 2025 IEA Coal Mid-Year Update 2025, IEA Publishing. Licence: www.iea.org/t&c

And yet, by mid-2025, coal-fired generation is down roughly 3%. Is the dragon finally easing off the black stuff? Not quite. Power-sector demand may be cooling, but China’s broader coal appetite remains hot—especially in hard-to-electrify sectors like chemicals and synthetic materials. The International Energy Agency (IEA) forecasts only a 0.5% dip in total coal use this year. So, what’s really going on? Let’s unpack China’s coal puzzle—from supply dynamics to pricing signals, policy levers, and geopolitical ambitions—and why the world’s coal compass continues to tilt toward Beijing.

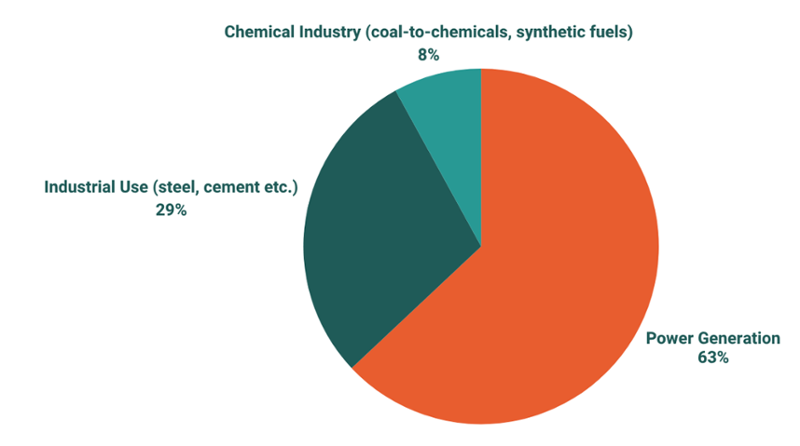

China’s Coal Demand by Sector (2025) – Coal-fired power demand down 3% in 2025; chemical use stable amid industrial shift

Fonte: Elaborazioni su dati IEA e IEEFA

Why Coal Isn’t Going Quietly in China’s Grid

Think of coal in China not as a relic, but as a loyal friend who shows up when others flake. In 2024, electricity demand surged by 7%—an eye-watering 550 TWh jump. Renewables and hydro grew, yes, but they couldn’t plug the whole gap. So, coal did what it always does in China: stepped up. While steel and cement cooled off, China’s chemical industry marched on—and it runs on coal. Coal isn’t just burned in boilers; it’s baked into the very structure of ammonia, methanol, and synthetic fuels.

Then came a policy twist. In June 2025, China kicked off power market liberalization—a shift that’s making solar and wind competitive in places like Northwest China. That’s starting to chip away at coal’s economic edge. Yet, paradoxically, coal production is climbing.

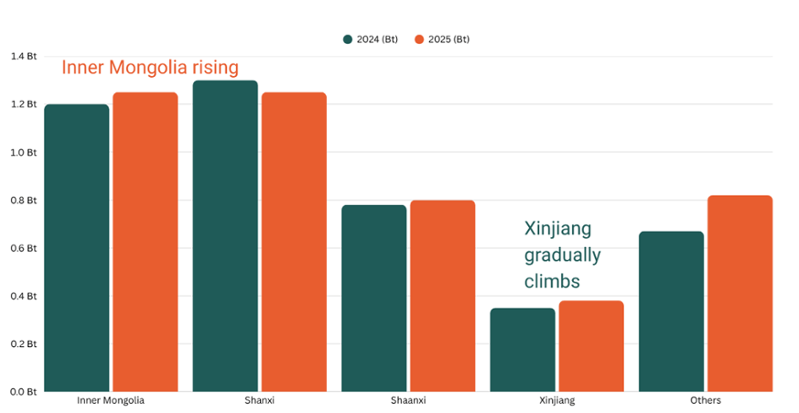

Oversupply or Insurance? China’s Coal Strategy Is Anything But Accidental

Here’s where it gets counterintuitive. Despite flat demand, coal output reached 4.666 billion tonnes in 2024, with expectations of 4.8 billion tonnes by year-end 2025. The new mining capacity? Around 105 million tonnes, mostly thermal coal. Why produce so much if you don’t need it? Because this isn’t overproduction—it’s strategy. Coal is China’s energy insurance policy: it’s domestic, easily stockpiled, price-controllable, and impervious to international supply shocks. In a world where LNG prices whipsaw and solar intermittency frustrates reliability; coal offers something precious: predictability.

China’s coal production by region (2024-2025)

Source: IEA, Coal 2024 Report, China National Bureau of Statistics (NBS), UNDP, Reuters

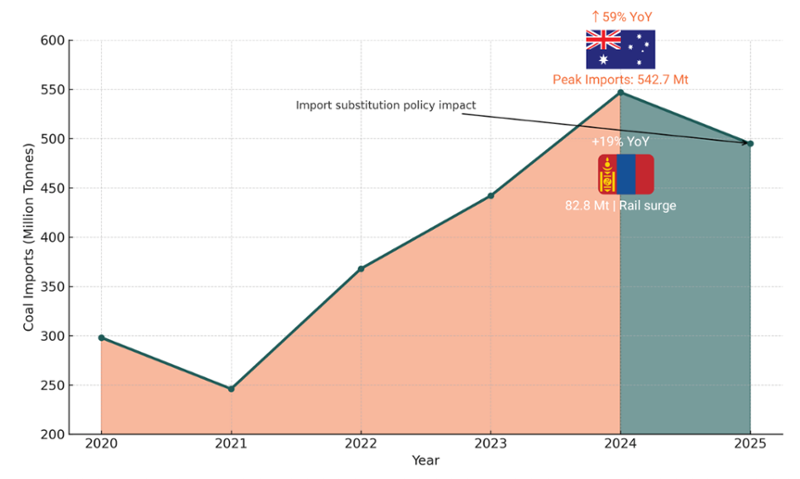

Reading the Trade Ledger | What China Buys—And What It Doesn’t

Let’s flip over to the import side of the ledger. In 2024, China went big—really big. It imported 542.7 million tonnes of coal. That’s a 14.4% jump, a new all-time high, accounting for over 41% of the global coal trade in one year. Talk about dominating the market. But fast-forward to mid-2025—and the script flips. Imports in the first half of the year? Down 11.1%. Just 221.7 million tonnes.

What happened? Beijing started flexing its domestic muscle. More local production, tighter controls, and a strategic shift from buying abroad to building within. Call it what it is: a course correction, not a coincidence. The full-year forecast? Somewhere between 450 and 497 Mt—a 9–18% decline, depending on how the second half plays out. But don’t mistake this for shrinking demand. Far from retreating, China is refining its energy calculus.

Domestic production is strong, stockpiles are well-padded, and China is leaning harder into energy self-reliance. Imports are becoming a pressure valve, not a lifeline. Let’s talk about what happened in 2024. Australia sent 83.24 million tonnes of coal to China—a massive 59% jump. Why? Because the two countries finally buried the hatchet and reopened the trade gates. Mongolia wasn’t just watching—it delivered 82.82 million tonnes (marking a 19% rise), thanks to better rail links and even better politics. Indonesia stayed on top, but here’s the twist: its shipments didn’t grow. In fact, they flattened out—nudged by local policy changes and price competition.

So, what does all this mean? Some might call it a slowdown. But that’s not what’s really happening. China is recalculating—leaning more on domestic supply, and using imports as a backup, not a necessity. As a result, global trade patterns are shifting.

Price markers like Newcastle and ICI-4? They’re quietly adapting to China’s evolving tastes. And for coal exporters, think this is temporary? It’s more like a pivot in disguise.

China coal imports: 2020-2025

Source: Reuters and Mining.com

Coal Prices | Managed, Not Mayhem

Coal prices are whispering a story of calm control—not chaos. By mid-2025, Qinhuangdao benchmark coal fell to 660 yuan/ton (~US$91)—down 25% from early October 2024. Seaborne prices echoed the slide: Australian 5,500 kcal at $70/t, Indonesian 4,200 kcal at $48/t—the lowest levels since 2021.

The World Bank forecasts an average global coal price of $100/t in 2025—a 27% drop year-over-year. Unless China or India mounts a major demand rebound, prices could fall further in 2026. Still, this isn’t a price collapse. It’s a managed descent.

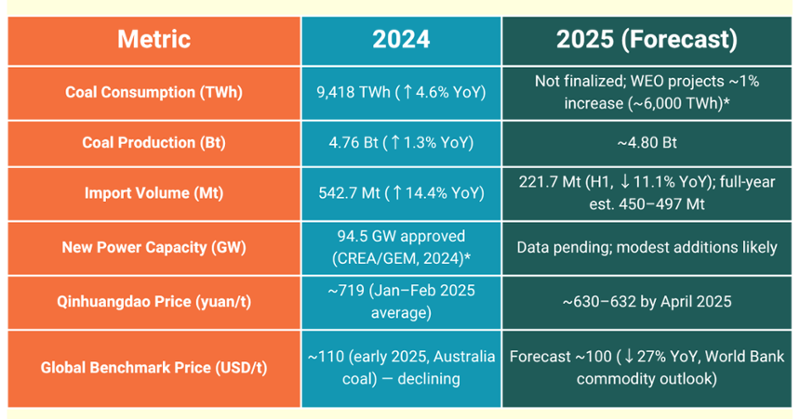

China’s key coal market metrics: 2024 performance vs 2025 outlook

Source: Author Elaborations on National Bureau of Statistics, Mysteel, IEA, China Daily HK, Reuters, Mining.com, EnergyNews.pro, Miningmx, SunSirs, World Bank Blogs data

The Coal-Renewables Paradox | Hedging, Not Hypocrisy

China talks green—but banks on black. In 2024 alone, it approved ~94.5 GW of new coal-fired power capacity—the most since 2015. Is that a contradiction? Not really. It’s a hedge.

Beijing understands the structural limits of wind and solar: curtailment, seasonal variability, and regional imbalances. So, it relies on a multi-layered playbook:

- Capacity payments to keep coal plants idle-but-ready

- Mine safety restrictions to nudge supply without triggering price spikes

- Long-term contracts to shield against global coal price volatility

Coal here isn’t just a commodity—it’s a control mechanism.

More Than Megawatts | Coal as Geopolitical Lever

China’s coal play isn’t just about energy. It’s about influence.

Here’s what’s shifting:

- From Dependence to Dominance

Coal buys time while China secures strategic energy assets—rare earths, uranium, overseas refineries—in Africa, Central Asia, and Latin America. - From Conformity to Challenge

China is resisting Western fossil fuel phaseout narratives, insisting that energy security cannot be sacrificed on the altar of timelines. - From Open Markets to Selective Alignments

China is deepening trade with politically aligned suppliers like Russia and Indonesia, while quietly reducing exposure to more unstable relationships.

The ripple effects? New shipping routes, shifting alliances, and a recalibrated global carbon debate.

So, Is China Doubling Down on Coal? Yes—and no.

Coal demand isn’t booming, but it’s stable. Supply is deliberately ample. Imports are flexible. Prices are soft, not slumping. And policy ensures coal remains central—not as a dirty habit, but as a pillar of strategic resilience. In short, coal is no longer China’s energy fallback. It’s the country’s energy bulwark. That’s why any serious conversation about the future of coal—economically or geopolitically—begins and ends with China.