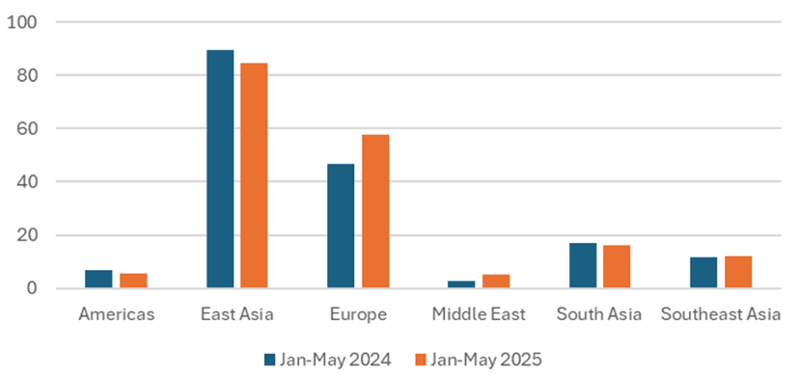

Europe has taken a greater share of the LNG market this year as it raised its prices to divert cargoes away from Asia to ensure steady injections into gas storage facilities after a colder winter. Europe, including the UK and Turkey, took in 32% of global LNG imports during January-May 2025, up five points from January-May 2024, when the region received 27% of deliveries. In absolute terms, Europe took in an extra 11 million tonnes, reaching a total of 57.7 million tonnes. In January 2025 ICIS LNG Edge ship-tracking recorded seven ships that were heading from the US to Asia making dramatic course-changes in the mid-Atlantic to head back to Europe instead. This was an unusually high number.

Within Europe, France remains the single biggest importer, due to its extensive LNG import capacity. Germany’s imports remain fairly small compared with France, Spain, Italy and the Netherlands. Although Germany built several new terminals in the last few years to replace Russian pipeline gas, the terminals are more expensive than some older facilities, and some traders prefer to deliver to other countries when possible.

LNG import, million tonnes

Source: ICIS

Most of the decline came from East Asia, whose imports fell to 47% of the market, down from 51% the year before. The biggest change was from China, whose imports during the five months fell by over 7 million tonnes, or 22%, to 26.0 million tonnes. China’s economic slowdown has reduced LNG demand, while the country is also relying more on its own production and pipeline imports from Russia. Chinese companies have long-term cargoes under contract from the US, but they can resell these into Europe instead.

Japan and South Korea were more stable, while Taiwan’s imports grew 12%, with the country having stopped its last nuclear power plant in May 2025 and opened a new third LNG terminal.

The switch back to Europe in the first half of 2025 is a change from last year. In 2024 it was Asia that was increasing its share of the LNG market. The winter was fairly mild at the start of 2024, for the second year in a row, so Europe’s gas storage was fairly high, and Europe didn’t need to fight as hard to stop cargoes going to Asia.

In 2024 as a whole Europe took only 24% of global LNG imports, down from 30% in 2023. That share of the market was fairly evenly split across the rest of the world. For example the East Asian countries of Japan, China, South Korea and Taiwan took 52% in 2024, up from 50% the year before. The South Asian countries of India, Pakistan and Bangladesh took 10% in 2024, up from 8% in 2023.

Spot gas prices were high in Europe and Asia in January and February as Europe and Asia competed for LNG. But the market dropped back sharply from mid-February onwards after US President Trump opened up a new round of tariffs, leading to expectations of slower economic growth and lower energy demand. The front-month TTF gas price in Europe fell from a Euro 57/MWh high in mid-February to just over Euro 30/MWh in April-May.

Europe still needs to refill its storage, so further falls may be unlikely in the short-term. But there is a big increase in new production coming to the market in the next few years that could gradually push prices lower.

At the end of last year Cheniere started its stage III expansion at US Corpus Christi and Venture Global opened its Plaquemines plant, which will continue to build up over this year. BP has this year exported the first-ever cargoes from Senegal/Mauritania’s Tortue project. Canada is set to join the export market in coming weeks with the start of the 14 million tonnes/year LNG Canada project.

Major new expansions are to follow in the US and Qatar in 2026 and beyond, including the Golden Pass project in the US, which is Qatar’s first production outside of Qatar, and the North Field East and South expansions in Qatar itself. These will double the size of Qatar’s LNG output by the end of the decade, leading the market into a new wave of growth later in the 2020s. After the recent years of market tightness, the change into a softer market environment will be welcome to many buyers.