Liquefied Natural Gas (LNG) has become a central topic in discussions about energy security, geopolitics, and economic stability in Europe, particularly due to the continent's growing reliance on LNG imports amidst rising tensions with major natural gas suppliers like Russia. 2024 marked a significant milestone for the global LNG industry, its 60th anniversary, an industry which has progressively contributed to promoting new sources and better inter-regional trade and, as seen in the recent past, a fundamental means to managing energy supply tensions, while continuing to accompany Gas demand growth globally.

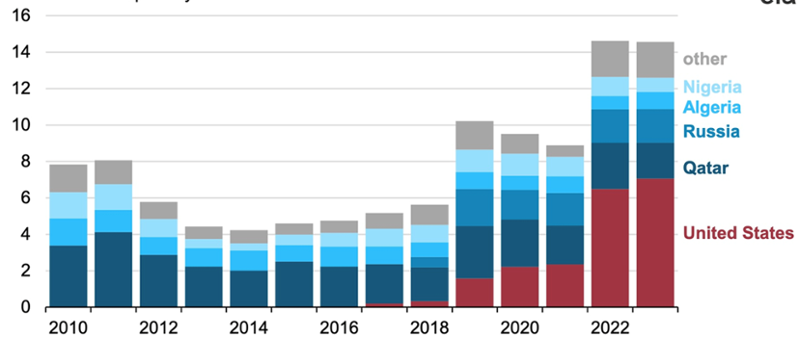

The Russian invasion of Ukraine in 2022 drastically altered Europe's energy landscape. Prior to the invasion, Russia supplied almost 40% of Europe’s natural gas. By late 2022 and 2023, Europe had significantly cut these imports, turning to alternative energy sources, including LNG. Europe’s shortfall from reduced pipeline gas imports from Russia was compensated by increasing LNG imports especially from the United States (see next figure).

Europe (EU-27 and UK) annual LNG imports by exporting country (2010-2023) billion cubic feet per day

Source: Energy Information Administration – US Department of Energy (DoE)

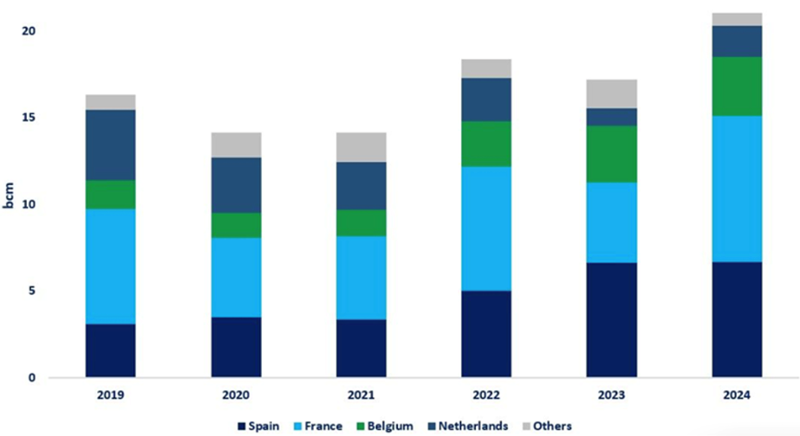

It is also worth noting, in any case, the limited but increasing role of Russian LNG in some European countries (figure 2).

Russian LNG deliveries to the EU surge to new record high in 2024

Figure 2. Source: International Energy Agency (IEA) elaborations FONTE ESATTA?

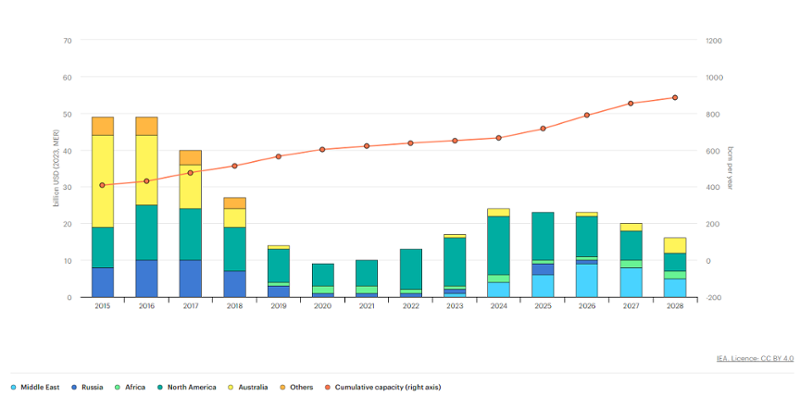

Several European countries have been building and expanding their LNG infrastructure, including regasification terminals, to accommodate this shift. Notable examples include new terminals in Germany, Netherlands, Italy, Greece and expanded facilities in countries like Poland. But – on top of additional regasification which will allow Europe to best address further flow diversification and, therefore, additional security of supply – it is essential to continue investing in new liquefaction capacity.

In this respect, figure 3 provides a representation of the pipeline of new projects (among which the USA and Qatar will continue being central, with some additional important initiatives in Congo, Mauritania, Senegal or Mexico to mention a few “newcomers”), providing a potential positive outlook to further accompany Gas demand growth globally.

Investment and cumulative capacity in LNG liquefaction, 2015-2028

Source: IEA elaborations

to avoid potential backlashes coming from scenarios and assumptions which could create some additional tensions in the market. On the positive side, the last days of 2024 saw the start of operations of the eighth LNG liquefaction plant in the US.

The International Gas Union – which I will be having the honour to lead as President after the upcoming World Gas Conference in Beijing in May 2025 – released a series of preliminary remarks in response to the DoE Report mentioned above, summarised as follows:

- underestimating the LNG demand, underinvesting or otherwise restricting additional LNG supplies can be highly detrimental for economies that are largely Gas-importing;

- the global LNG trade (including that of US LNG) provides an invaluable source of flexibility, energy security and energy access to multiple global regions, including a Europe that is still dealing with the aftereffects of the significant reduction of Russian Gas imports;

- restricting additional US LNG exports would also have a negative environmental effect since such restrictions would reduce the scope for Gas to displace high CO2 emissions fuels such as oil and coal. Coal production levels are already at record high and, as noted in the recently released International Energy Agency’s (IEA) Coal Report, the world’s coal demand reached the alarming figure of 8.77 billion tonnes in 2024.

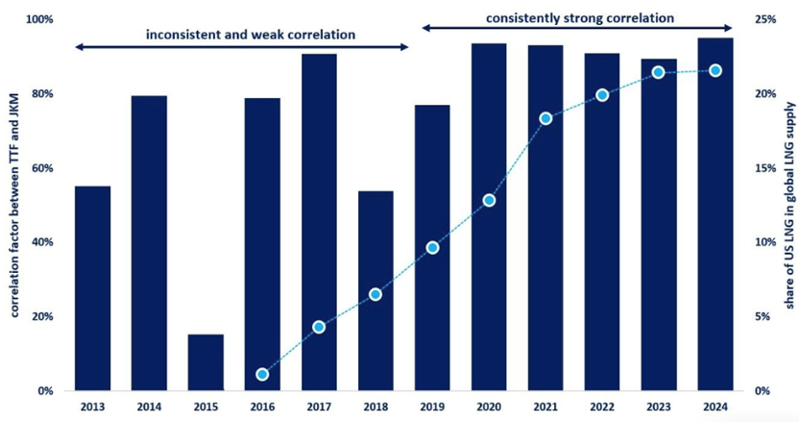

So, while the Europen Gas industry was relatively quick in rallying its forces to come up with alternatives to Russian pipe gas, the continent’s transition to a greater LNG role has led to increased energy competition, especially considering the constant increase in global demand and the additional tensions during winter months or when Asian markets compete for the same resources.

As we have seen in the recent months, European prices substantially increased again to around 50 €/MWh range, showing a mounting stress which will not only be relevant for this winter but – importantly – for the next storage filling season.

All of the above can be represented in figure 4 below, as tracking the substantial role of the additional LNG supplies (in specific the US ones) created a very strong correlation between TTF and JKM.

TTF vs JKM correlation hits all time high in 2024 amid growing liquidity

Source: IEA elaborations

This will require, among other matters, the need to review the approach to long term contracts which could provide more price and volume stability to address the supply and flexibility needs of the European markets. LNG has played a critical role in helping Europe navigate one of its most severe energy crises in recent history. However, its reliance on LNG comes with challenges, including economic pressures, geopolitical risks, and environmental trade-offs. Europe's energy landscape will likely continue to evolve as it seeks to balance immediate security needs with long-term sustainability goals.

As the International Gas Union has mentioned many times, particularly in our recently released Manifesto, Gas – in all its forms – is essential to human progress and global growth. To fully address a proper and complete “sustainability proposition”, we need to firm up energy security and affordability, to prevent rising energy costs – which we refer to in the industry as energy affordability, scarcity and poverty – that can fuel political and social unrest.

For this reason we, the International Gas Union, strongly call for a pragmatic approach to the energy transition, one that takes into account multiple forms of energy and how they can seamlessly be integrated to meet the various global net-zero targets. In this respect, Gas – and LNG as a new global “energy-glue” – will be part of any balanced considerations that continue serving energy needs and allowing the progression to address the current global climate challenge.