Northwest Europe is at the forefront of low-emissions hydrogen development. The region accounts for around half of Europe’s total hydrogen demand. It has vast and untapped renewable energy potential in the North Sea and a well-developed, interconnected gas network which could be partially repurposed to facilitate the transmission and distribution of renewable and low-emissions hydrogen from production sites to demand centres. The Northwest European Hydrogen Monitor provides an annual update of low-emissions hydrogen market developments in Northwest Europe.

Since Russia’s invasion of Ukraine, several Northwest European countries have doubled their hydrogen production targets, and others are considering increases. Altogether, Northwest European countries now have ambition to develop as much as 30 to 40 gigawatts (GW) of electrolyser capacity by 2030. Besides policies, Northwest European countries and the European Union continued to advance regulatory frameworks for low-emissions hydrogen in 2023. The delegated acts outlining detailed rules on the EU definition of renewable hydrogen were formally published in June 2023. And at the end of 2023, the European Union reached a formal agreement on the Hydrogen and Decarbonised Gas Markets Package, laying the foundations for the future European low-emissions hydrogen market.

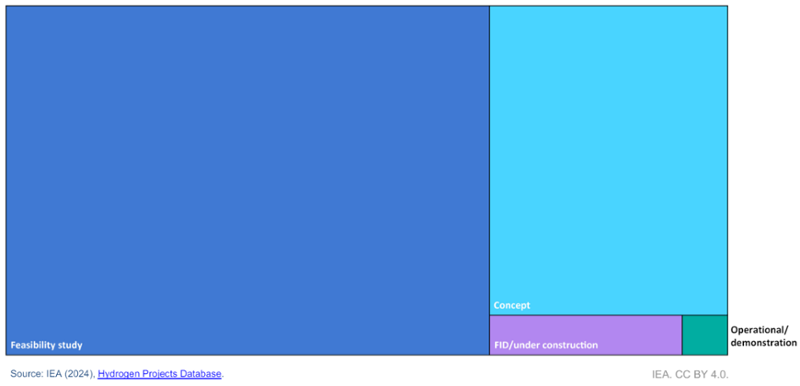

Based on the IEA’s Hydrogen Production Projects Database, Northwest Europe’s production of low-emissions hydrogen (and derivatives) could reach just above 7 million tonnes (Mt) per year by 2030 if all planned projects become commercially operational (and taking into account assumptions on efficiency and utilisation factors). However, less than 4% of the projects that could provide low-emissions hydrogen supply by 2030 have been committed, meaning they are either in operation, have reached a final investment decision (FID) or are under construction. More than 95% are currently undergoing feasibility studies or are in the concept phase.

Potential low-emissions hydrogen production in Northwest Europe in 2030 by status

Source: IEA (2024), Hydrogen Projects Database

Northwest Europe is playing a key role in developing international trade in low-emissions hydrogen. Based on announced projects that aim to trade hydrogen or hydrogen-based fuels, 16 Mt of hydrogen equivalent (H2-eq) could be moved around the globe by 2030. However, three-quarters of export-oriented projects are in early stages of development. Less than one-third in terms of volume by 2030 have identified a potential off-taker. Countries in the Northwest European region account for three quarters of global import volume by 2030 for which a final destination has been identified.

The relatively low share of committed projects highlights the need for a holistic approach to support the nascent low-emissions hydrogen sector. Scaling it up will require an effective, interlocking framework of subsidy schemes and support mechanisms along the entire value chain – including research and development, production, transportation and, in particular, demand creation.

Creating demand for low-emissions hydrogen is a key instrument to stimulate investment in low-emissions hydrogen supply including via quotas, fuel standards and public procurement rules. Demand security is essential for the conclusion of long-term offtake agreements, which in turn can help to de-risk investment and improve the economic feasibility of low-emissions hydrogen projects.

In the European Union, the revised EU Renewable Energy Directive (RED III) sets legally binding targets for renewable hydrogen use in industry and transport by 2030. The implied renewable hydrogen demand in Northwest Europe under RED III would be approximately 1.6 Mt by 2030, rising to 2.3 Mt by 2035. This is well below announced low-emissions hydrogen ambitions from Northwest European countries. Combined with the absence of economic incentives to bridge the cost gap between renewable and fossil fuel hydrogen, this helps explain the difficulty many project developers currently face in securing offtake contracts.

Achieving ambitious targets for low-emissions hydrogen deployment will require accelerating the development of hydrogen infrastructure for transport and storage. Based on pipeline project announcements, the length of the region’s hydrogen network could increase tenfold to over 18 000 kilometres (km) by early 2030. However, the majority of announced projects lack firm investment commitments, which also reflects current uncertainty in demand.

Developing underground storage capacity for hydrogen will be crucial for it to reach its full potential as an energy carrier and respond to the evolving flexibility requirements of a more complex energy system. Based on the IEA’s Hydrogen Infrastructure Projects Database, Northwest Europe could develop over 3 terawatt-hours (TWh) of hydrogen storage capacity by 2030. However, just 10% of the expected capacity by 2030 has reached FID and/or is under construction.

Steep cost reductions are needed to make renewable electrolytic hydrogen competitive with unabated gas-based hydrogen. Initial price discovery suggests that renewable hydrogen prices stood almost three times of the assessed levelised cost of hydrogen (LCOH) from unabated gas in 2023. Under the IEA’s Announced Pledges Scenario (APS), which assumes countries implement national targets in full and on time, the decline in renewable electrolytic hydrogen production costs, together with a carbon price of over USD 135 per tonne of CO2- equivalent, could ensure that the levelised cost of hydrogen from renewable electrolysis is comparable with the LCOH from unabated gas in the region – and in certain cases, it would be lower.