The Russian invasion of Ukraine and subsequent cut in pipeline gas exports to Europe created a massive imbalance in the fundamental outlook for the global supply and demand of gas. Whether or not some or all this Russian gas comes back into the market, the US LNG industry has wasted no time in trying to fill this potential supply gap by aggressively moving ahead with both multiple greenfield LNG projects and project expansions. While the total volume of nearly 100 Bcm/yr. of new US capacity emerging in the second half of the decade will not be enough to completely fill the Russian void, it will provide much-needed liquidity to a waterborne market that is in a never-ending search of more flexibility and price transparency.

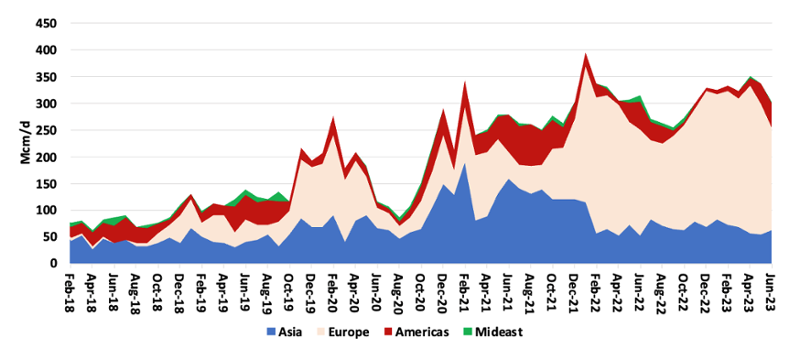

US LNG export by region

Source: SPGCI, 14 countries including the UK

The gas war in Europe preceded the land war by roughly 9 months and started in April 2021, when Russia stopped filling its European gas storage ahead of the next winter. By October 2021, when European gas storage was 16% below the 5-year average and by 25% below Y/Y, US LNG exports began shifting rapidly to Europe in larger volumes. A wider TTF/JKM spread, which widened from -$0.10/MMBtu in April to an average of $5.00/MMBtu in 2023, helped create the incentive to do so. This shift was not some sort of latter-day Marshall Plan; it was purely commercial, highly profitable, and available for the taking thanks to the highly flexible fob terms established by the sellers in US LNG contracts. As long as most Russian pipeline gas does not return to the global gas market, this larger portion of US LNG is likely to remain headed for Europe.

Through a series of new LNG contracts and FIDs, the expansion of US LNG has accelerated. The interesting juxtaposition emerging with US LNG is that while so much volume has shifted to Europe, the long-term contracting of US volume has not necessarily done so. European end users have been somewhat reluctant to sign long-term deals. The position is understandable, given the uncertainty surrounding how much Russian pipeline gas will eventually return to the system. While security of supply is important, so is price and the risk of low-cost Russian pipeline gas returning to the market is too great for many end users to risk overcommitting to LNG supply.

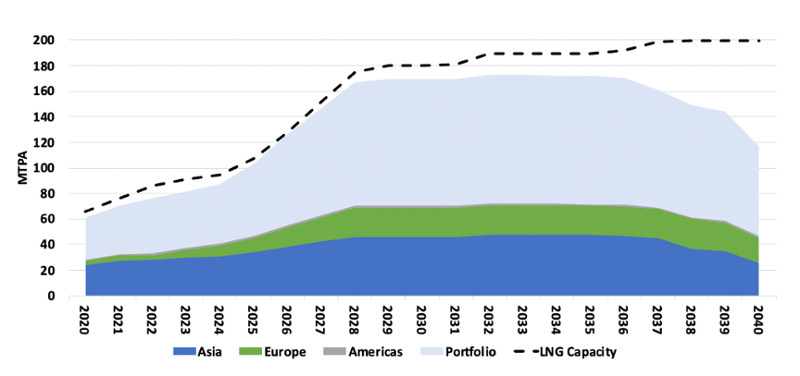

Europe seems to be taking the middle road on US LNG supplies, relying on many Europe-based energy and trading companies to step into the void and sign contracts. These companies may or may not re-sell volumes into the European market based on price. Relying on these so-called portfolio players is a risk, but also a hedge against future supply risk that avoids a fuller financial commitment to supply. Buyers are weighing the risk of being short for several weeks or months of the year against being more chronically long for up to two decades. The kind of supply shock that occurred in 2022 and 2023 warrants a look at signing a long-term deal, but it must be weighed again a European gas market that is shrinking and has been for the better part of two decades. Buyers are faced with securing gas through more contracts or buying more spot gas and putting it into storage to de-risk ahead of winter. However, buyers also know these same portfolio players need access European storage during injection season, as part of their long-term strategy of taking advantage of seasonal balancing for Europe and Asia. Either way, the gas is coming to Europe; it’s just a matter of who owns the time risk of storing it.

US LNG Contracts

Source: SPGCI

Portfolio buyers have secured US contracts to maximize flexibility and optimize their global trading position. Through ownership of various quantities of liquefaction, shipping, and regasification, portfolio players will look to use new US LNG capacity as a seasonal shifting point in global trade. Other than the marketing arms of the LNG producers, four of the larger European portfolio companies, Shell, TotalEnergies, BP, and Naturgy, account for 33% of US offtake as of 2023. These four buyers are a portion of the nearly 60 different buyers that have signed up for US LNG supply. Asia buyers account for 37% of the total, although this total diminishes to 27% by 2030.

While long-term contracts have not been necessary to green light US LNG capacity and its expansion – Golden Pass LNG is largely unsigned and set to begin commissioning by late 2024 – they have played a central role for companies requiring financing. The cautionary journey ahead for LNG markets is that long-term contracts with portfolio players have done wonders for greenlighting the expansion of US LNG supply. However, like the Qatari expansion, most of this portfolio volume signed up from US producers remains unsold to an end user market. Who will actually consume the LNG or gas, and at what price, remains an answer shrouded in commercial mystery.