LNG held centre stage at the recent International Gas Union (IGU) World Gas Conference held in Beijing last month, and that is hardly surprising given the global LNG market movements and the Asian continent’s appetite and commitment to further distance itself from carbon-intensive fossil fuels such as coal.

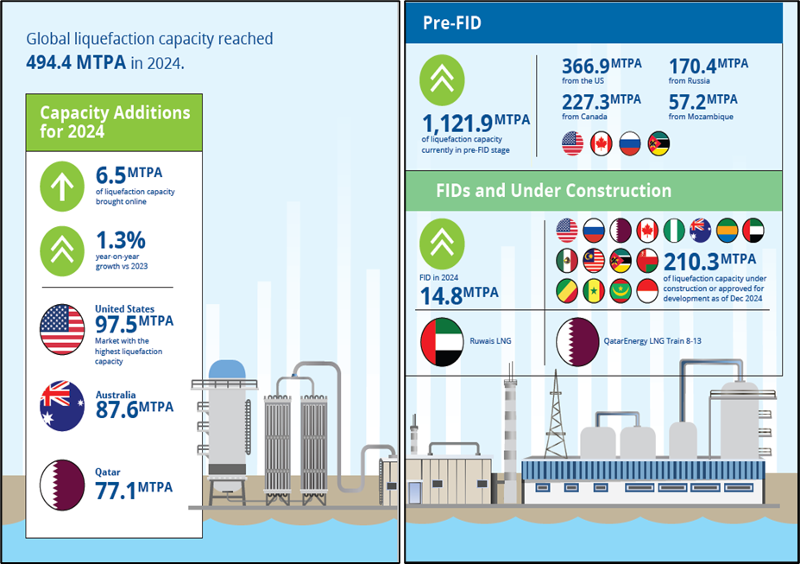

According to the recent IGU 2025 World LNG Report, global liquefaction capacity continued to grow, reaching more than 494 MT in 2024, with more than 210 MT as FIDs and Under Construction, plus many additional projects still in the Pre-FID, which can strongly increase the LNG availability in the coming years to best support the market growth and additional flexibility requirements of diverse geographies.

Liquefaction capacity: key trend

Source: IGU

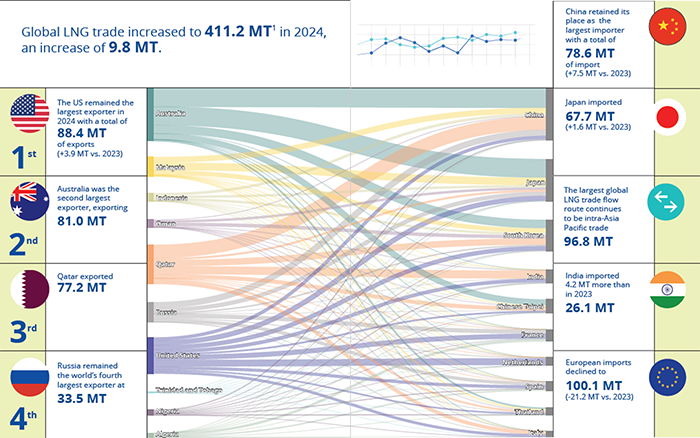

Global liquefied natural gas (LNG) trade grew by 2.4% in 2024 to 411.24 million tonnes (MT), connecting 22 exporting markets with 48 importing markets.

Although the European LNG imports declined sharply, falling 21.22 MT year-on-year to 100.07 MT in 2024 especially due to high storage volumes and a still subdued gas demand, LNG demand rebounded in Asia, with China (+10%) and India (+19%) posting strong year-on-year growth in LNG imports, driven by heatwaves, infrastructure expansions, and greater reliance on gas-for power.

Asia Pacific remained the largest trade flow region with around 97 MT in 2024.

Global LNG trade: key trend

Source: IGU

Though the global LNG market remains presently tight, it would be interesting to see what the extra capacity soon to come online from the US, Qatar and Canada will do to the LNG demand and supply, particularly as China is investing significantly in its regasification infrastructure, and the destination clauses have been removed from most contracts.

The standoff between the US and China had escalated to prohibitive tariffs of 140% on US LNG. Chinese buyers are among the selected few buyers combining high enough credit quality and sufficient long term demand certainty to absorb large quantities of LNG for multi-decade durations, affording them an increasingly important role in the ongoing wave of US FIDs.

Despite the influx of LNG supply in the late 2020s, the demand for Gas as a long term fuel will continue to grow. Therefore, the global Gas industry’s executives present at WGC2025 mentioned that it was imperative for us all to continue taking a proactive approach in ensuring that LNG supplies remain reliable and sustainable.

In addressing the current complex state of the global Gas market, collaboration across the entire industry’s value chain is essential, as together we can foster strong partnerships and implement fit-for-purpose cross-regional policy frameworks that are conducive to market stability and, therefore, futureproof to any potential energy crisis.

Infrastructure and access to finance played a significant role in the discussions and debates during WGC2025, particularly how the private finance sector can better collaborate with the sovereign governments of both exporting and importing nations to aid not just in the ultimate goal of energy transition but, primarily and immediately, provide much needed energy to those markets and consumers who need it most.

And this is particularly true in geographies where LNG can play a fundamental role to foster economic growth and social development, accompanying a reduction of emissions from more polluting fuels.

In fact, industrialisation and socio-economic development are largely dependent on having access to energy that is both reliable and affordable – the flexibility of LNG, providing bunkering and related regasification terminals are in place at destination, can make the difference between an energy “winter” and an energy “spring”. We tend to forget that which we are used to and come easily to us yet, as a global critical industry, we know that energy is security.

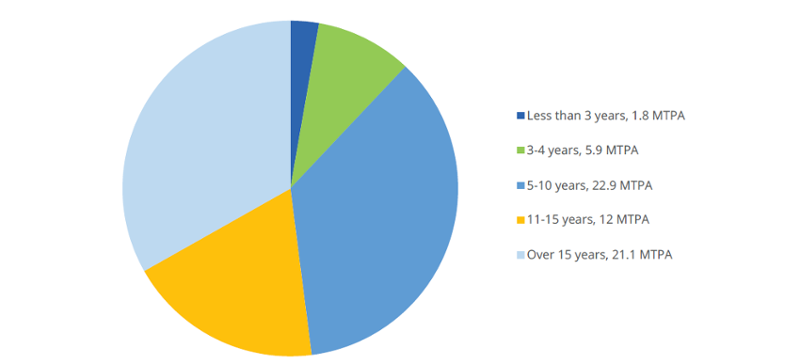

To facilitate the transition from coal to Gas and/or LNG and to guarantee a more balanced and less volatile market, fair pricing mechanisms that incentivise long-term commitments by both importers and exporters are fundamental.

Global Sales and Purchase Agreement (SPA) duration signed between 1 January 2024 and 31 December 2024

Source: IGU

At the same time, our industry is constantly innovating (and we don’t tell the world enough about it). Also LNG will benefit from a combination of operational improvements and real technological breakthroughs, including CCS and CCUS, which can definitely allow Gas to play a fundamental role in the coming decades to meet the growing energy needs of the global population while reducing the carbon footprint.

In this respect, appropriate and pragmatic regulatory policies, openness to financing Gas projects and market-driven approach to supply-demand balancing will be essential to avoid future tensions.