In Spain, the publication of the European Hydrogen Strategy in 2020 sparked widespread enthusiasm among the government, regional administrations, the private sector, and, to some extent, civil society. This momentum was reinforced a few months later with the release of the Hydrogen Roadmap for Spain, at a time when the country was grappling with the economic and social crisis caused by COVID-19. Hydrogen development was seen as a tool for industrial transformation and economic diversification, positioned as a key driver of green industrialisation. The roadmap set an ambitious electrolyzer target of 4 GW by 2030, representing 10% of the EU’s 40 GW goal.

In 2022, the Russian invasion of Ukraine and the European Commission's call in the EU REPowerEU to increase the level of ambition for renewable hydrogen raised Spain's ambition to a higher level, reinforcing its external dimension and including the construction of an underwater hydrogen pipeline connecting Barcelona to Marseille. With the updated version of the Spanish Energy and Climate Plan, the electrolyzer target was elevated to 12GW by 2030, positioning Spain as an emerging hydrogen hub in the EU. The high expectations did not only come from the Government. Major industry players also embarked on an escalation of targets that included refinery owners (Repsol, Cepsa, BP) and utilities (Iberdrola, Endesa, Acciona) which presented a very active and promising sector.

In 2025, most of this euphoria has been dissipated and the sector confronts and uncomfortable reality. Only a small fraction of the mega-projects have reached the final investment decision (FiD), given the realisation that renewable hydrogen prices will not fall as fast as previously thought, nor will demand for it grow in the short term if it is not competitive with fossil alternatives. Those projects underway have not yet taken off or passed their pilot phase due to the technical challenges associated with the technology and the difficulties in finding offtakers to leverage demand. The feeling in the industry is one of caution: the vast majority of companies have reduced their targets, or simply no longer mention them, and committed investment seems to be directed towards more marketable options.

The case of the HyDeal project is particularly illustrative. Once envisioned as Europe's largest green hydrogen initiative, failed primarily due to its inability to secure long-term commitments from key offtakers like ArcelorMittal for green steel and Fertiberia for low-carbon fertilizers. Despite the availability of Next Generation EU funds, which could have supported infrastructure development and CAPEX, the project's financial model relied heavily on securing firm purchase agreements to anchor demand. Its collapse had significant regional implications, particularly for Asturias, once a coal mining region and now a demographically declining area that had hoped to leverage HyDeal to drive economic revitalization.

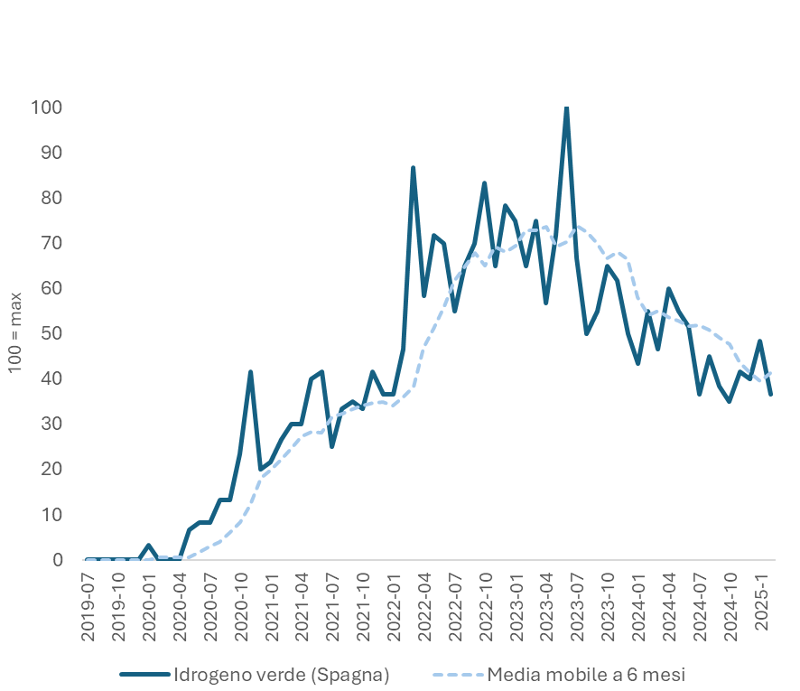

Media and public attention have followed a similar trajectory. While in 2022 and 2023, hydrogen frequently made headlines and was a common topic on talk shows and news programs, by 2025, it has largely vanished from the spotlight. Google searches in Spain for the term “renewable hydrogen” also reflect this shift, highlighting the fading prominence of the topic in the general public.

Google search "for green hydrogen" in Spain

Source: Google Trends

The industry is now split between those who, despite the evidence, are going all-in to secure the competitive advantage of early adoption and those who quietly shift their focus toward more profitable operations. The role of hydrogen as a key industry in a decarbonised Spanish and European economy is unquestionable, as is its value as a vector for industrial decarbonisation. The greatest uncertainty lies in when green hydrogen will achieve cost parity with fossil alternatives, even when factoring in reasonable subsidies or the internalisation of the carbon price. In this sense, Spain appears to have moved too early, reminiscent of its experience with the first wave of solar power deployment in the early 21st century.

In conclusion, for the Spanish energy sector, the last five years have been a long dream journey in terms of hydrogen: it is a shame that from the dream of leading the transition process thanks to this new technology that has enormous potential for change, we have gone to the nightmare of realizing that things, for now, will not be so simple.