The European Guarantee of Origin (GO) market is a complex landscape shaped by each country's unique regulations and practices. For instance, Germany's strict issuance restrictions create a tight local supply, while the Netherlands sees heightened demand due to its comprehensive disclosure requirements. Meanwhile, countries like Norway and Iceland, with abundant green energy production, export their surplus GOs, impacting market flows beyond their borders.

Understanding the distinct characteristics of GO markets across the EU is crucial for appreciating the broader challenges and opportunities in Europe's energy transition.

Germany, driving demand due to stringent issuance rules

As the largest economy in the European Union, Germany's market dynamics significantly influence the rest of Europe, and the green electricity sector is no exception. To grasp why, it is important to understand Germany’s two main routes to market power volumes.

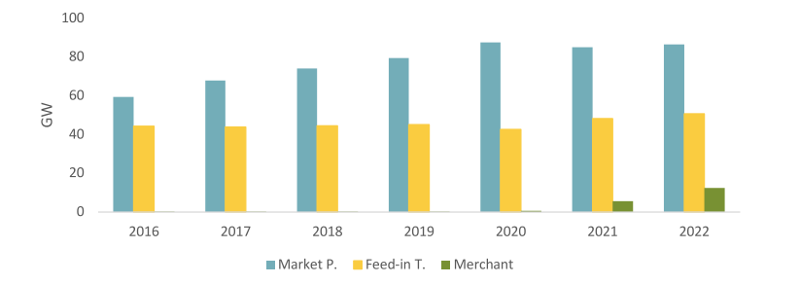

First, they can sell their power through government support schemes—either the feed-in tariff or the market premium—which provide financial backing for up to 20 years. Alternatively, producers can sell their energy directly on the wholesale market or through power purchase agreements (PPAs). This merchant-based approach is gaining traction as renewable energy investment costs drop and older support agreements expire.

A distinctive feature of Germany's green electricity legislation is that GOs are only issued for power sold commercially without benefiting from the feed-in tariff or market premium schemes. This unique rule not only sets Germany apart but also influences the broader European GO market.

Installed capacity registered under Germany’s two support schemes remain significantly higher than that of merchant assets, as the incentive to leave the scheme is minimal without an earnings cap, unlike two-sided CfDs used in other jurisdictions. This means that only ca. 8% of Germany's renewable fleet is actually eligible to receive GOs.

Installed RES Capacity in Germany according to its Route-to-Market (GW)

Source: THEMA Consulting, Green power trading and GOs in Europe and Germany

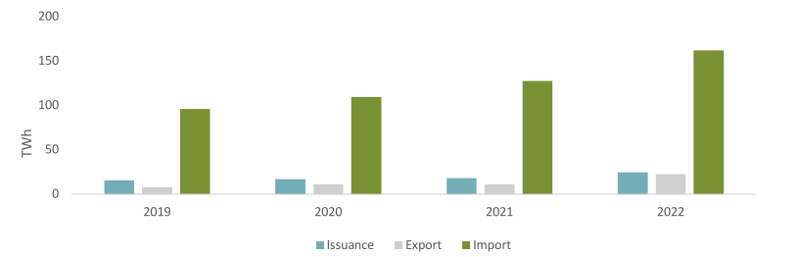

Low issuance levels, resulting from the mismatch between total green energy generation and the green power eligible for certificates, leads to a limited supply of GOs in the market. High demand for green electrons in Germany stemming from environmentally conscious consumers and industries adhering to rather strict green accounting standards, forces pushes German market players to acquire GOs from neighboring markets to balance the supply-demand gap, making by far it the largest importer of GOs, and thus steering overall demand behavior in the GO market.

GO Transaction Volumes in Germany (TWh)

Source: THEMA Consulting, Green power trading and GOs in Europe and Germany

Norway, shaping supply with large hydro volumes

As Europe ramps up its renewable energy efforts, the share of wind and solar in the GO market has risen to about 30%. Despite this growth, Nordic hydro power still leads the way, supplying around 45% of GOs.

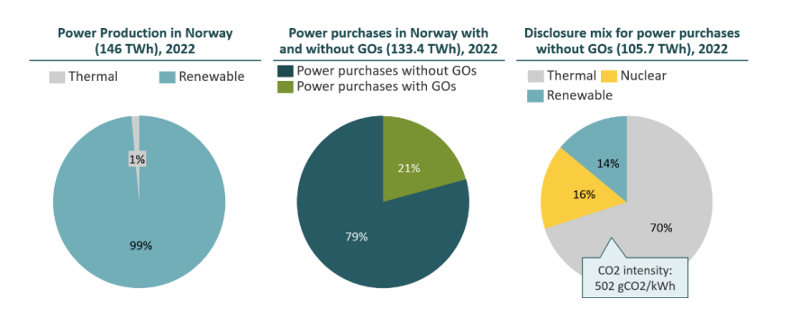

Norway stands out with 98% of its power coming from renewable sources. This high percentage might suggest for some that nearly all electricity in Norway is green, but the reality is more nuanced due to differing approaches to green electricity accounting.

In Norway the debate on emission accounting stemming from electricity is quite divided. For example, some companies, like battery-maker Freyr and aluminum producer Hydro, champion a location-based approach. They argue that greenhouse gas emissions should be calculated based on the local generation mix, warning that different methods could, for instance, let coal-powered plants falsely appear green by using GOs.

On the other hand, companies like industrial giant Yara support a market-based approach. Here, GOs certify green energy consumption, and electricity from the grid without GOs is considered grey, regardless of the country's energy mix.

This lack of uniformity in carbon accounting, combined with the misconception that Norwegian electricity is green, leads to low domestic demand for GOs. Currently, less than a quarter of all power purchased in Norway is linked to a GO. This scenario not only increases the apparent carbon intensity of Norway's generation mix but also creates an oversupply of GOs, making Norway the largest exporter of these certificates, and conditions influencing hydro generation in Norway (i.e. dry seasons or formation of surface-ice) influence the overall GO supply dynamics.

Norwegian RES production and disclosure mix in 2022

Source: THEMA Consulting, Green power trading and GOs in Europe and Germany

The Netherlands, driving regulatory developments

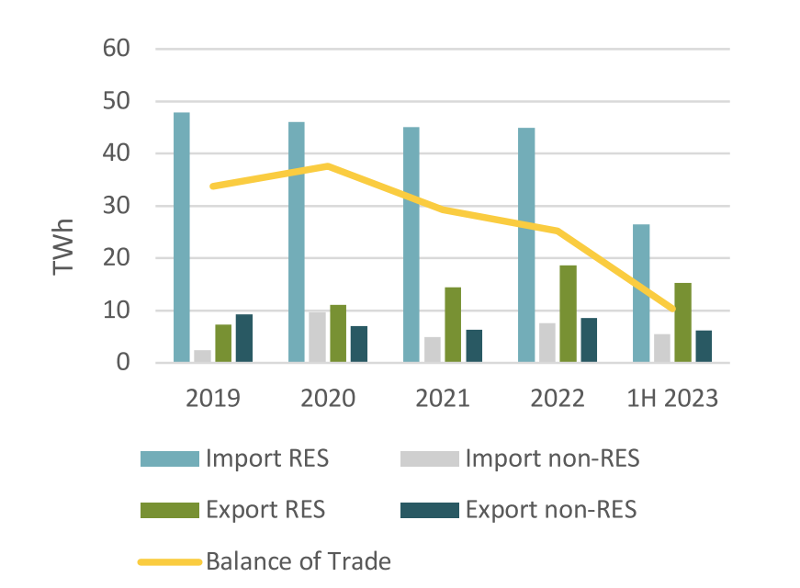

The Netherlands has been at the forefront of extending the Guarantee of Origin (GO) certification beyond renewable energy sources to include all types of power production, a concept known as full disclosure. This approach mandates documentation and certification of every MWh generated, enhancing transparency and consumer choice.

Since the implementation of full disclosure rules in 2020, demand for local GOs in the Netherlands has increased, reducing the net import of GOs and bolstering green power generation domestically, underscoring the effectiveness of the Dutch approach.

External trades on the Dutch GO registry

Source: THEMA Consulting, Green power trading and GOs in Europe and Germany

In January 2023, CertiQ, the issuing body for GOs in the Netherlands, merged with Vertogas to form VertiCer, a unified entity for both power and gas green certificates. This merger aims to enhance market integration and streamline GO certification processes. VertiCer also plans to introduce certificates for carbon capture and storage facilities, expanding its scope and reinforcing the Netherlands' leadership in green energy certification.

The diverse approaches to the Guarantee of Origin (GO) markets across Europe underscore the continent's complex journey toward a unified green energy future. Each country's unique strategies and regulations not only reflect their individual energy landscapes but also contribute to the broader European energy market dynamics. Understanding these differences is crucial for appreciating the intricate challenges and immense potential in Europe's transition to sustainable energy. As nations continue to innovate and adapt, the collective efforts will shape a cohesive and efficient green energy market, driving forward the global renewable energy agenda.