All alternative marine fuels exist on a pathway from fossil-fuels (grey) to renewable based synthetic e-fuels (green). For some fuels, this pathway includes a biogenic fuel derived from sustainable feedstocks such as human or agricultural waste, as is the case for bio-LNG or bio-methanol. For others, this biogenic mid-point is unlikely to exist at scale, for instance bio-ammonia.

The end destination for all of these fuel pathways is compliance with environmental regulations such as the revised International Maritime Organisation’s (IMO) GHG reduction strategy: reaching net-zero emissions from international shipping "close to" 2050 on a life-cycle basis. Let’s examine the LNG route in more detail.

Step 1: LNG

For an accurate view of emissions, we need to consider the entire fuel pathway, not simply the net-zero or zero-emissions destination. That also means considering the emissions of the initial grey fuel.

Almost all alternative fuels used today, including LNG, are fossil-based. In fact, most are produced from natural gas. LNG is simply natural gas that has been cooled to the point it liquefies making it easier to transport and store. Natural gas, and sometimes coal, is the feedstock for almost all methanol, ammonia and hydrogen production today.

Source: Sphera, ABS and SEA LNG Analysis

Uniquely, according to Sphera’s 2nd Life Cycle GHG Emission Study – the definitive study of LNG as marine fuel – LNG offers a reduction in GHG emissions of up to 23% compared with oil-based marine fuels on a full life cycle basis (well-to-wake), inclusive of methane slip. The study is based on primary data from all major marine engine manufacturers and peer-reviewed by independent academics. While 23% is not the end goal, it moves us farther ahead than other alternatives available today in sustainable quantities.

Step 2: Bio-LNG

Bio-LNG, a net-zero step on the LNG pathway, can play a significant role in shipping’s decarbonisation. This was the finding of the Maritime Energy and Sustainable Development Centre of Excellence (MESD CoE) at Nanyang Technological University Singapore (NTU Singapore) in its recent independent study, The Role of Bio-LNG in Shipping Industry Decarbonisation. Based on conservative figures and allowing for demand from other industries, MESD CoE found bio-LNG could cover up to 3% of the total energy demand for shipping fuels in 2030 increasing to 13% in 2050 as production capacity increases.

Bio-LNG production will benefit from economies of scale and technological learning the report forecasts. Average costs for delivered bio-LNG will fall by 30% by 2050 compared to today’s values, mainly driven by scaling biomethane production in large-scale anaerobic digestion plants. In this scenario, bio-LNG will be the cheapest sustainable alternative marine fuels, cheaper than bio-methanol, e-ammonia and e-methanol.

Data available through SEA-LNG’s Bunker Navigator tool, shows bio-LNG bunkering is also available today in almost 70 locations worldwide, including Europe, North America and Asia.

Step 3: Renewable Synthetic e-LNG

Synthetic fuels, including renewable synthetic e-LNG, e-ammonia, and e-methanol are all derived from the same building block: hydrogen produced from electrolysis of water using renewably sourced electricity. The renewable electrical energy accounts for around 70%-80% of their costs. Therefore, scaling up renewable electricity and electrolysis capacity for e-fuels, and closing the cost gap between fossil and clean fuels, are common barriers that all alternative fuel stakeholders must work collaboratively to overcome.

It should be noted, however, that all the fuels on the LNG pathway including e-LNG can be dropped into existing LNG infrastructure and LNG-fuelled vessels with no changes required – providing a cost advantage. These fuels can all be blended with each other to incrementally adopt lower-emission versions in line with supply – offering a practical approach to reaching the ultimate goal.

Analysing the pathway not only the destination

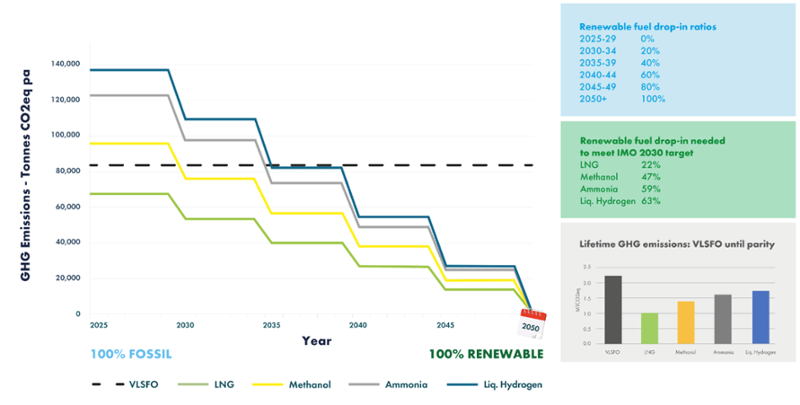

SEA-LNG has conducted comparative analysis of the emissions of the LNG, methanol, ammonia and liquid hydrogen fuel pathways. The implications for the climate and for shipowners can be best understood by looking at an example investment decision.

This figure illustrates the case of a duel-fuelled 14,000 TEU container vessel coming into operation in 2025 and with a 25-year lifespan. In the below scenarios, renewable fuels become available at increasing scale from about 2030 onwards.

14K TEU Container Vessel: well to wake GHG emissions of different marine fuels

Source: Sphera, ABS and SEA LNG Analysis

The modelling shows LNG offers immediate GHG reductions over VLSFO and all other alternatives, decreasing to zero-emissions by 2050. The bar chart shows a reduction in cumulative emissions over the lifetime of the vessel, on a well-to-wake basis. The lifetime reduction in GHG emissions for the LNG pathway is more than 50% compared with VLSFO; for methanol and ammonia the corresponding reductions are 37% and 28% respectively.

LNG is available right now, worldwide, and in volumes sustainable over the long term. Other pathways involve waiting for biogenic or green fuels that are not available at any significant scale. Other pathways unfortunately will result in prolonging oil-based fuel use.

The practical pathway

When looking at the progress along the LNG pathway, and evaluating the entire pathway on a well-to-wake basis, it is clear that LNG offers a lower-risk, lower-cost and incremental pathway for decarbonisation. Most critically, that pathway starts today, not years or decades in the future. This is why shipowners and other marine stakeholders are investing in LNG. LNG bunkering is available around the world right now and offers immediate GHG reductions. Bio-LNG is increasingly available and supply is scaling up rapidly, and while e-LNG faces the same production challenges as other e-fuels, the use of LNG will continue to benefit from established LNG infrastructure and supply chains and from the strong collaboration and cooperation that is a hallmark of the entire LNG industry value chain.