Faced with a declining market and increasing competitive product imports from modern source-refineries, the European refining sector is likely to encounter stiff competition in the medium term. With all EU refineries being exposed to (international) competition, some have become part of the mores of international markets, while others have remained largely part of a local habitat. With the expected longer-term decline in demand for refined products in the EU and the increasing competition from low cost refining export centres in the medium term, asymmetric paths of survival are expected, potentially resulting in changing value-propositions across the segmented refining sector in the European Union. Specifically, the integration in external value chains proves to be a strong indicator whether a refinery is more resilient in a competitive landscape in the long-run, while also its ability to improve carbon efficiency depends on the integration capacity.

The share of refineries in the EU that are indeed likely to benefit from such integration (e.g. petrochemical integration or a sheltered inland market) is especially substantial along the “Rhine-Danube Line”. Outside this core area of strong points, the EU refining sector in the Mediterranean, Scandinavia, and the Balkans is expected to have a higher exposure to competition of product imports due to the larger share of stand-alone and coastal refineries and scattered demand centres. In other words, the lack of a captured market, low levels of integration, and available import facilities create a realistic case for product imports into parts of the refining market of the European Union, exposing local refineries to increasingly fierce competition.

In line with EU emission targets for industry, processing emissions will have to be 80% below 1990 levels in 2050. In absolute terms, the European refining sector’s GHG emissions already decreased since its peak of 144 Mt CO 2-eq in 2005 to 118 Mt CO2-eq in 2015 as a result of increased utilisation, closure of refining capacity and production efficiency measures. However, while total sector emissions in 2015 decreased to approximately 1990 levels, total refined product output is roughly 20% lower than 1990, indicating that the carbon efficiency per unit has actually decreased. This is due to the growing complexity of the remaining refineries and the ability to produce higher value oil products from darker inputs.

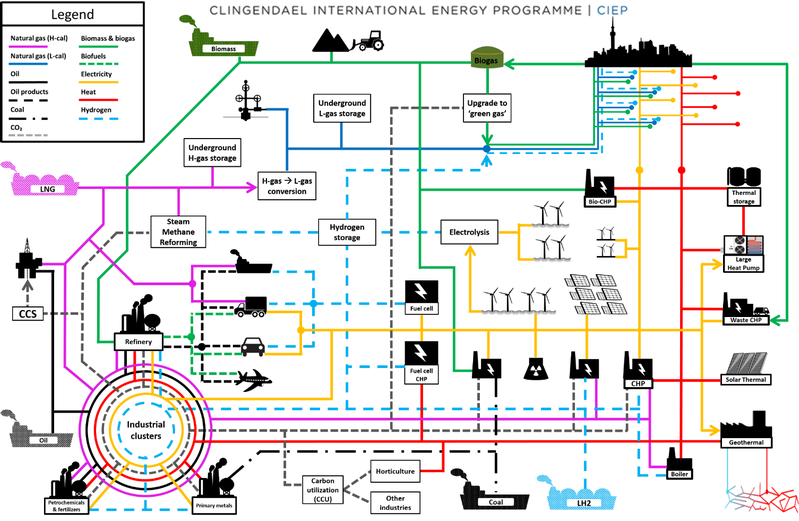

Despite the energy transition policies and projected lower petroleum demand in the EU, refineries will occupy a key position in the EU’s future energy mix for years to come. Hence, strategic concerns over increasing import dependency on refined products remain valid if the EU is becoming strategically too import dependent. Nevertheless, it is also likely that the traditional value proposition of EU refineries may be subject to change when markets and government climate and energy policies evolve in the future. The energy transition will likely create future business opportunities for which refineries have a preferred position as an innovative hub for multiple energy streams and expertise in the conversion of clean molecules. Also in a low carbon energy economy, the European economies need, in addition to electricity, substantial volumes of liquids and gases. According to the IEA NPS, approximately 27% of total energy demand is assumed to be electrified in 2040, implying that 73% should come from ‘molecules’. Some of these molecules will be derived from (green) gasses, such as hydrogen, or other bioenergies, but a substantial share will come from liquids.

Promising measures to reduce a refiner’s carbon footprint are the optimization of internal efficiency measures as well as new ways to integrate refineries into local economic value chains (e.g. heat, electricity, RES-hydrogen, e-fuels, biofuels and CO2). These measures will decrease the refining sector’s carbon intensity whilst ensuring the still needed refined product supply for instance for the petrochemical sector. Potentially some of the emission reduction can be realized further down the hydrocarbon value chain for instance in the chemical sector. Most importantly, this route may be more cost-effective as it utilizes existing assets, preventing the early termination of multi-billion-dollar assets.[1] This is further amplified by the significant barriers-to-exit that prevent refiners from an ‘easy exit’ as substantial clean-up costs force them to think about alternative business models, mitigating an expensive remediation and closure.[2] However, barriers-to-integrate, such as no demand to use the waste heat or no connection to CO2 infrastructure and storage facilities, prevent refineries from cooperating with local industry in order to capitalize on existing carbon reduction potential outside their gates.

One of the most promising potentials for the future of transportation fuel supply is e-fuels. These are fuels, such as hydrogen, produced with renewable energy sources which can be used: a.) in electric drive trains with fuel cells; b.) for the production of methane or methanol used in combustion engines, via the process of methanation with carbons; c.) to produce liquid hydrocarbons (e.g. gasoline, jet fuel, diesel) via catalytic synthesis of hydrogen and carbons. The carbon molecules needed for methanation or synthesis can either be sourced from CCS or extracted from the air. The advantage of e-fuels is the usage of existing assets. Bio-fuels also have significant potential. The oily substance from algae can potentially be processed in conventional refineries, producing conventional fuels (e.g. gasoline, jet fuel, diesel) while at the same time reducing the value chain’s carbon emissions.

Figure 1: Vision on an integrated energy transition

Governments can facilitate energy- and carbon efficiency of refineries by removing some of the obstacles to integrate, for instance by organising CO2 infrastructure and storage capacities. For individual refiners, it is clear that only measures inside the refinery gate are not enough, and that energy- and carbon efficiency measures outside the refinery gates require cooperation across sectors and governments to realise the deep carbonisation required for a low carbon economy in 2050. It is therefore important that governments or other institutions that can organize these new markets and infrastructure to come about, recognize the potential contribution of refineries to a low carbon energy system.

The ability for refineries to improve both energy and carbon efficiency may differ. Refineries in countries where CCS is developed to collect CO2 from large point sources may be better positioned to live up to the demands from national climate change policies and international competition than refineries with little to no ability to abate their process emissions and/or integrate in other market segments, for instance heating. Early strengthening of deeper integration of refineries will depend on the future role in a portfolio or industrial cluster, while other refineries may wait for tighter regulation and/or stiffer international competition to decide on the investment strategy.

[1] Speaking notes CIEP gas day (2017) “Integrated Energy System Transition”

[2] An alternative business model could be, for example, conversion into a biorefinery, specialty refinery or a storage terminal. See, for example, Bergh, Nivard & Kreijkes (2016) “Long-term Prospects for Northwest European Refining: Looming Government Dilemma?”