Coal is the most abundant source of electricity generation worldwide, currently contributing over 36% of the world's electricity supply. Coal-powered plants which around 16% of the electricity in the United States. Coal is an energy resource that is produced domestically. Nearly total volume of coal is mainly utilized for domestic electricity generation comes from U.S. mines. In contrast, significant energy sources such as nuclear and renewable energy depend heavily on imported minerals to power nuclear reactors or build wind turbines and solar panels.

According to the Pristine Market Insights report, coal plays a dominant role in the advanced high strength steel market because of its involvement in steel production processes. The conventional process of steelmaking, especially through blast furnaces, is highly dependent on coal as a reducing agent, resulting in high carbon emissions. This further raises questions about environmental sustainability concerns and compels the Advanced High Strength Steels (AHSS) market to adopt greener alternatives.

As per the International Energy Agency (IEA) report 2024, global coal demand reached a record of 8.77 billion tons (Bt) last year, 1% more than the previous year's record. Asia was once again leading the world in coal use for the yet another time. Coal use in Europe and America had significant falls in 2023.

The State of Coal Reserves Globally

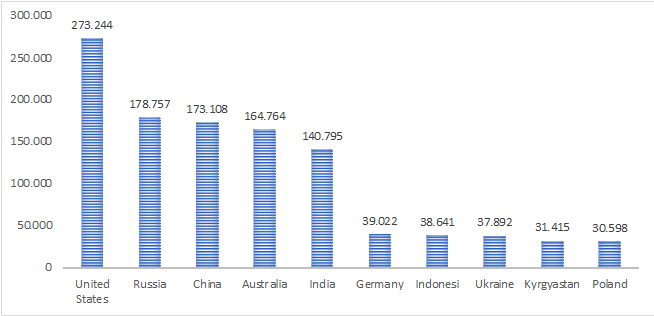

Worldwide, coal reserves are extensive, featuring significant deposits in Asia, North America, and Australia. Despite growing environmental issues, coal continues to be an essential energy source, especially for developing economies and industrial uses.

Coal Reserve in Million Short Tons

Geological elements such as deposit depth, rock type, and seam thickness influence the viability of mining. Technological advancements mainly including remote sensing and automation, improve extraction efficiency, tackling difficult terrains and increasing access to reserves. Coal mining in vulnerable areas poses threats to habitats, water quality, and air cleanliness.

The Economics of Coal Mining and Global Investment Trends

The worldwide coal market is affected by industrial expansion in developing countries, energy generation requirements, and export necessities. Pricing trends are influenced by supply-demand interactions, fuel replacements, and ecological regulations. Multinational players as well as government-owned enterprises significantly influence mining and coal investments, impacting market dynamics. Major players consist of firms such as China Shenhua Energy, Glencore, and BHP, whose investment approaches emphasize broadening operations, securing resources, and managing environmental regulations. These tactics influence coal prices and accessibility around the world.

Even with its influence on climate, the coal industry continues to expand. Thermal coal output has reached record levels, and the worldwide coal power capacity increased by 30 GW in just the past year. In total, 216 GW of coal power capacity has been introduced worldwide.

This exceeds the total capacity of the current coal fleet in the United States. 40 % of the firms on the global coal exist list are focused on coal development and intend to create new thermal coal mines, coal power plants, or coal transportation facilities.

Out of these, 376 coal mine developers continue to aim for an annual thermal coal output of 2,636 million tons, which is nearly 35% of the global thermal coal production at present. This list features 286 coal plant developers who continue to plan for 579 GW, which represents 27% of the global coal power capacity. Investment in mining is moving away from coal's carbon impact toward the clean energy landscape, where solar, wind, and lithium extraction fuel the electrification movement, creating a sustainable, low carbon emission future.

Furthermore, global environmental, social, and governance standards are increasingly applicable across all businesses globally, including the coal industry. These are largely focused on reducing carbon imprints, disposing of waste, reducing environmental decay, and improving good governance methods. For coal firms, this simply translates to embracing cleaner technologies and stricter environmental laws to lower their carbon footprints and compliance with stricter environmental laws to lower their carbon footprints ESG metrics also emphasize social responsibility. It entails improving working practices, dealing with local people, and ensuring health and safety standards. The coal industry is now more answerable for its impact on staff and local populations, which includes reducing its negative impacts on the two.

Coal's Future: Carbon Capture and Hybrid Energy Systems

Emerging technologies like carbon capture and storage and advanced combustion technologies are altering the environmental footprint of coal by enabling cleaner releases. Automation and artificial intelligence are revolutionizing the mining of coal, making it more efficient with less human risk. With the world moving toward a low-carbon world, coal's flexibility to complement renewable energy through hybrid systems like coal-gasification offers a transitional solution.

Conclusion

In the intricate ballet of energy requirements and environmental needs, coal's international footprint is still definitely enormous. Even as there is an increasing move toward cleaner sources, countries such as China, India, and the U.S. are still utilizing coal deposits in abundance, determining the destiny of mining investments. As economies look for sustainable growth, a paradoxical situation arises coal is at once a bridge and a hurdle.

Future investments in mining will increasingly focus on innovation, ranging from cleaner methods of extraction to carbon capture technologies. But the larger challenge is how to balance economic imperatives with environmental stewardship. Coal's future will be determined not only by market forces, but by how well the world balances this complex web of progress and preservation.