Germany positions itself as central transit hub for European gas. It is no coincidence that that Germany’s gas market operator named itself ‘Trading Hub Europe’ when founded in October 2021. Ambition and mission carried in one name. Shortly after the foundation of THE, the Ukraine war hit Germany’s gas market dramatically. A large reconfiguration of gas flows in Europe followed. Germany started to import gas flows from Western neighbours France, Netherlands and Belgium. The country increased inflows of Norwegian pipeline gas and it speedily built LNG terminals.

Germany’s hasty rush into the LNG market was deemed a success story in its initial phase. The speed at which the country managed to build LNG infrastructure and secure supplies to replace dwindling Russian gas supply was coined as new ‘Deutschland-Tempo’. The capacity build-up of LNG terminals has been endorsed as bipartisan strategy across political groups to secure gas supplies for Germany in the absence of Russian gas.

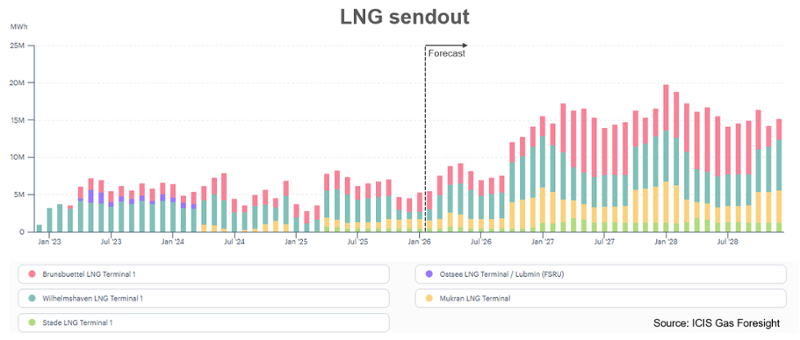

Two years after Wilhelmshaven’s inauguration the market situation is challenging. European LNG terminals had a moderate 2024. Terminals Stade and Lubmin are hardly utilised at all. Only three vessels unloaded in Germany in January 2025. German LNG capacity operators (DET Deutsche Energy Terminal GmbH, Deutsche ReGas) are grappling with lower demand under new market conditions. DET contemplated partially shutting down capacities at Wilhelmshaven over Q1/2025 on grounds of outstanding EU permits and the new Stade facility gets postponed repeatedly. Court action by environmental organisations tie up resources as well as complaints by competitors Deutsche ReGas and Hanseatic Energy Hub on unfair market conditions.

German terminals rely heavily on volumes traded short-term on spot markets, mostly of American origin. The reliance on spot volumes puts German terminals in disadvantage compared to land-based terminals in neighbouring countries as short-term capacity bookings are usually more expensive than long-term capacity bookings, as proven in a report of European regulator ACER on 2024 LNG markets. Going forward ICIS expects the current expansion plans to not be challenged by government but possibly by the market. It looks oversized with more than 500 TWh/year send-out capacity amounting to half of future German gas demand. Early signs indicate that market interest proves weaker than desired in the long-term. The commissioning of new US LNG projects is welcomed by German government in a bid to diversify energy sources and commitments to phasing out traditional energy sources gradually to maintain energy security and industrial strength. Yet, German LNG relies too heavily on US LNG with a 92% market share in 2024.

The short-term outlook for German LNG is positive though: Imports are set to rebound in 2025. The expectation of high gas storage injections and absence of Russian flows over 2025 has sent European gas above Asian prices. Average European terminal utilisation increased to 45% in January 2025, up from a low 36% in Q3/2024. Germany’s Wilhelmshaven is 80% utilised at reduced capacity (40% of full capacity), Brunsbüttel 80% of full capacity whereas Stade & Lubmin at zero. There is room for more LNG entering Germany in 2025. DET auctioned all its free capacity slots in its early February 2025 auctions at reasonable prices (up to 0.6 €/mmBTU). ICIS expects LNG imports into Germany to increase over the horizon to 2028 due to new long-term contracts wit US players and industrial gas off-takers. Also, players from Central and East Europe seem interested in German LNG capacity as in entry point for US and other LNG into Central and East Europe.

LNG sendout historic data and forecast for Germany

Source: ICIS Gas Foresight

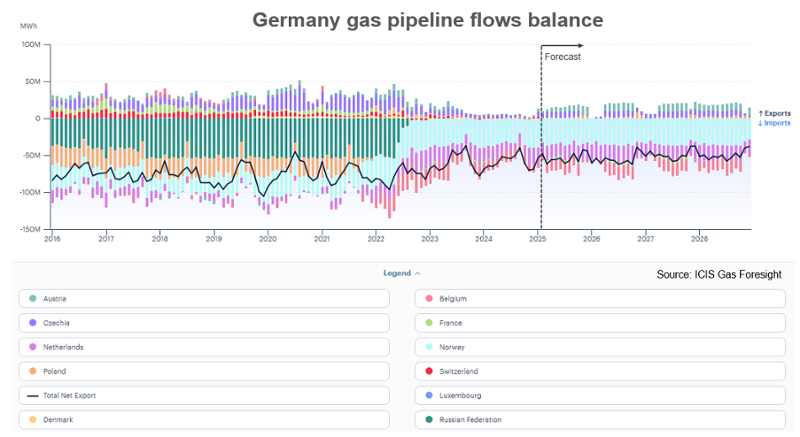

Gas flows across central and eastern Europe were being reconfigured since early 2025 as Ukraine’s historic transit of Russian gas came to a halt. West-to-East is the new direction and Germany benefits from its more pronounced role as central transit hub.

The scrapping of the German storage levy from 1 January 2025 was incentivizing flows from Germany to the region. The neutrality charge was officially scrapped at all cross-border points after a period of parliamentary instability raised fears it would not be cancelled in time for the new year. The end of the fee saves money for exporters and this is important for Germany’s role as hub. If the fee had been retained, if would have added an extra cost of €2.99/MWh for the export of gas volumes.

German flows to Austria jumped to 13mcm/day on 1 January, up from an average of 3mcm/day recorded in the previous fortnight. Flows projected on this route are expected to remain in similar territory. On the Czech border, eastward flows from Germany rose also to 13mcm/day on 1 January, up from an average of under 1mcm/day recorded between 16-31 December 2024. Since early January, the picture remains largely unchanged and ICIS Gas Foresight sees a prominent role for German gas exports to Austria and Czech Republic going forward with some seasonal variation.

Pipeline-based gas net exports of Germany

Source: ICIS Gas Foresight

Germany is known to have a pragmatic realpolitik approach to external trade policies. An immediate reopening of Nord Stream pipeline seems unlikely even if Ukraine peace talks succeed. German political parties object reviving a dependency they have just weaned themselves off. However, it is well possible that flows via Ukraine transit might resume and German energy traders would conclude deals on spot gas deliveries with Russian players again. The same holds for LNG imports into German LNG terminals partnering with Novatek or Gazprom. Peace in Ukraine would be a pre-condition. Trade between German and Russian gas agents would further cement Germany’s role as transit hub.

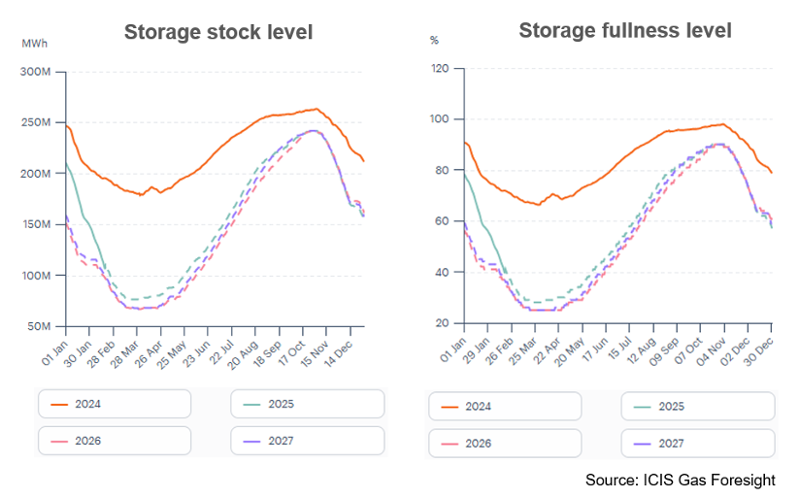

A key aspect in assessing the role of Germany in European gas markets its role as provider of security of supply through large storage capacity. German gas storage is key in covering winter peaks of gas demand in Central and East Europe. Germany has Europe’s largest gas storage capacity with around 250 TWh. The current fill rate of 40% is a staggering 30%-points below previous year and the country struggles to reach the 90% target by November. ICIS Gas Foresight expects a doubling of injection demand from 80 TWh summer 2024 to 160 TWh in summer 2025 should the targets be maintained. A relaxation of obligations would ease summer 2025 market tightness.

Storage fill rates in Germany

Source: ICIS Gas Foresight

With its massive expansion plans for LNG import infrastructure, Germany is set to become a key transit hub with relevance for Central and Eastern Europe. This is even more true with the stop of Eastern gas flows from Russia via the Ukraine transit. The market observed a reconfiguration of gas flows from West to East since the outbreak of the Ukraine war in 2022 and after the January 2025 Ukraine transit cut. Peace in Ukraine can shift the picture again, but Germany stays central in either scenario. Trade between German actors with Russian players could be revived again cementing Germany’s role as central hub. Adding to this, Germany maintains an important role as provider of security of supply through gas storage to cover winter peak demand.