Russia’s invasion of Ukraine was followed by tougher western sanctions on Russian financial and energy sectors. Although Russian gas was not restricted at the start, Moscow referred to the western sanctions to start reducing gas flows via Yamal-Europe and Nord Stream pipelines. The two routes account for 60% of piped capacity used by Russia, whereas the alternative would be to ship gas via Ukraine, the country at war.

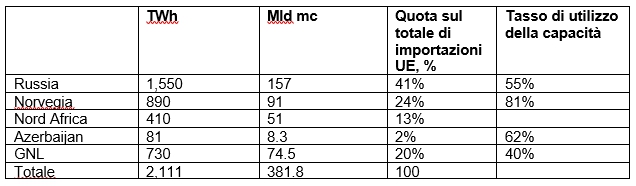

Since then, European importers introduced emergency measures which include an increasing purchase of liquefied natural gas (LNG) as the main alternative to the Russian gas. Before the crisis, by the end of 2021, LNG import terminals were still underused with 40% of utilisation rate, while other alternatives to Russian piped gas (i.e. Norway) have a lesser margin of manoeuvre (Table 1).

Structure of EU gas imports, 2021

Source: Bruegel, 2022

A switch to LNG has been rather successful, even despite record-high prices. By the end of 2022, the share of LNG surpassed Gazprom’s piped gas, whose volumes continued a decline since the explosion of the Nord Stream pipelines in September 2022. By that time already, Russian piped gas supplies collapsed by 45% on year-to-year basis. Instead, LNG imports attained historical highs in terms of import volumes. Yet, LNG supply chain has faced several difficulties, including low production growth in most of the exporting states, inadequacy of tankers shipping LNG and a tough international competition for floating storage and regasification units across the globe. In this context, EU states tended to exempt Russian LNG from any possible restrictions. To remind, Russian LNG exports are not covered by Gazprom’s monopoly and operated by a privately-owned Novatek. As Gazprom’s supplies volumes kept declining, Novatek’s exports kept rising, bypassing Gazprom’s volumes in the first half of 2023.

Although Novatek is a privately-owned company, it is still tightly controlled by Kremlin. Back in 2014, in the aftermath of Crimea annexation by Russia, the company’s owner Gennady Timchenko has been under EU personal sanctions list because of his close ties with Russian Presient Putin. After the invasion of Ukraine, Gennady Timchenko decided to withdraw from the board of directors in order to “clean up” the company’s reputation amid difficult context for business opportunities.

In 2022, EU’s imports of Russian LNG increased by some 20% compared to the previous year. In the first quarter of 2023, up to 25% of all LNG arriving to the Iberian peninsula – where Europe’s largest LNG capacity is located - was sourced in Russia. Other major buyers of Russian LNG are Belgium, France and the Netherlands, whose gas import infrastructure ensures a major part of gas supply in the western side of the Continent. A paradoxical situation emerges, where efforts to reduce dependence on Russian piped gas is done by increasing import volumes of Russian liquefied gas.

Unlike Gazprom, who holds exports on Russian piped gas, Novatek does not have public ownership. Even more, the company has been exempted from export duty, which makes it more difficult for Kremlin to collect revenues from LNG exports; still, Novatek provided budget revenues from profit tax. In fact, data from the Ministry of Finance of the Russian Federation demonstrates a hike of revenues from all gas exports – either liquefied or piped – since the fall 2022. As the piped gas exports declined, revenues from profit tax from the natural gas (both piped and liquefied) increased.

For these reasons, Ukrainian activists attempted to exert pressure on EU institutions to ban Russian LNG. Meanwhile, in the EU, policy discussions on this matter have already evolved. Already in February 2023, Estonia proposed to introduce price caps on Russian LNG in order to reduce Russian budget inflows from Novatek. Later, the European Commission has initiated discussions on various possible measures blocking Russian LNG imports.

Yet, the feasibility and the success of the restrictions against Russian LNG will depend on the following factors:

- Europe’s ability to secure long-term contracts with alternative suppliers in order to annihilate de dependence on Russian LNG;

- Continuous increase of US LNG exports to Europe despite the rising gas demand in North America;

- Competition with Asia on the available LNG supplies, which may become acute if China’s gas demand keeps rising and absorbing rising production.

With no doubt, European Union will have to weight different options before introducing restrictions against the Kremlin-friendly company, which accidentally became an unwanted helper.