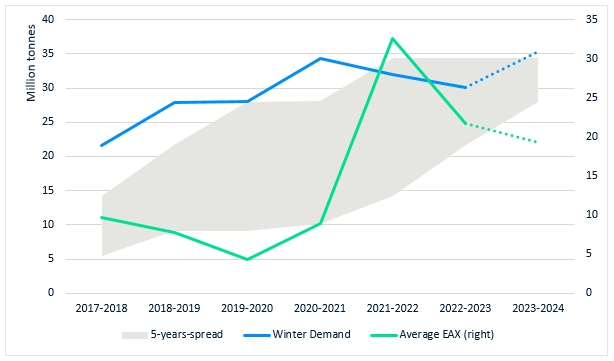

In the coming winter, China is expected to emerge as a significant driving force in the East Asian market as the nuclear and coal power reduces the LNG demand in Japan and South Korea. Chinese winter import broke new levels every year from 2016 to 2020, as the result of the country’s economic growth and the coal-to-gas switching policy. Heating demand has been a major factor that drove up winter gas consumption. On average, Asia spot LNG price in winter has been in single digit number, except for the past two years. As such, China has been a major spot buyer during winter due to its relatively affordable price of below US$10/Mbtu.

Chinese LNG consumption dropped for the first time in history during the 2021 winter, down by 7% year-on-year (yoy) from its peak of 34m tonnes. At that point, ICIS EAX (North Asia spot price) averaged US$33/Mbtu, tripled the average winter spot price in the last decade. The unexpected price spike and warmer-than-normal temperatures had tamed the nation’s gas demand. Coupled with a steady increase in domestic production, pipeline import and storage levels, China began to reduce its reliance on spot LNG.

Chinese LNG imports in winter (November – March)

Source: ICIS LNG EDGE

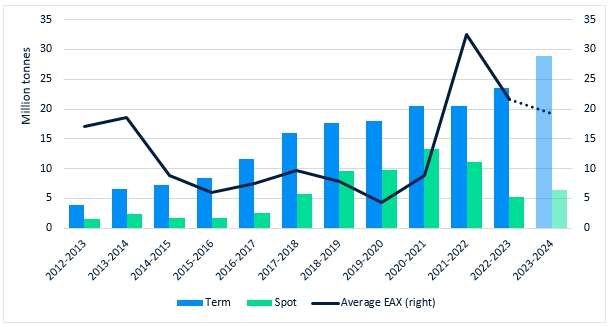

By 2022 winter, spot prices were volatile. At an average of US$22/mmbtu, most Chinese buyers viewed it as expensive and stayed away from purchasing. With its recurring lockdowns and a weaker economy, China’s spot LNG import declined by a further 54% yoy.

Chinese LNG import in winter by types

Source: ICIS LNG Edge

A softer EAX price of closer to US$10/mmbtu should incentivise Chinese spot purchase this winter. ICIS forecast an additional 12-18 cargos in spot cargoes, compared to last year. ICIS forward curve price is showing a return to the price range similar to the 2H 2021 – around US$16/mmbtu to US$20/mmbtu - and that Asia spot price (EAX) will lead Europe (TTF) by around US$3/mmbtu during this winter from November 2023 to March 2024.

‘The Pacific basin tightness this winter will be in a much bigger deficit than its Atlantic counterpart, indicating desperateness, which in turn will lead to stronger purchasing power in the east’, said Alex Siow, ICIS Lead Asia Gas Analyst.

China gas demand has been recovering with the demise of its Covid travel restrictions from January 2023. In 1H 2023, China consumed a total of 194 billion cubic meters of gas, up 6% yoy. ICIS expect the overall economic recovery to increase the winter LNG demand to 35.3m tonnes this winter, a 17% yoy increase.

However, the 2023 winter demand will build up at a slower pace compared to the last decade growth - prior to 2020 -, when Chinese winter averages 28% growth yoy. The two supply side factors are:

- the rise in domestic pipe gas take-or-pay clause limits switch over to spot gas;

- the increase in Chinese domestic production, pipe imports and storage levels at underground storages by 11% total yoy, adding an equivalent of 11.7m tonnes of LNG.

On the demand side, the following factors are suggesting a milder winter demand growth:

- a warmer-than-normal temperature forecast. Chinese Meteorology Center has recently forecast that 2023 winter to be possibly the mildest winter since 1850 in China;

- moderate recovery in the industrial sector;

- a larger contribution by the coal and renewable energy in the power policy.

The industrial sector, which accounts for almost 40% of total gas consumption, is a key indicator for a slower gas demand growth. The latest Q2 2023 industrial utilization rate indicated a 0.2 point increase, a mild recovery in manufacturing activities. This recovery is evidently limited as the rate is 1.6 point lower than the average Q2 rate in the last 5 years.

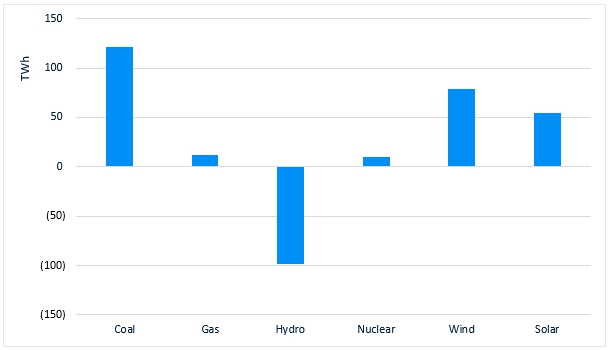

The robust development in the coal, wind and solar power generation is looking to offset gas power demand. The relatively higher cost of gas generation, especially during winter, has been the main obstacle to a higher gas generation. In the 1H 2023, wind and solar generations grew significantly, at 16% and 7.4% yoy respectively. Coal power output also jumped by 6% yoy, making coal the biggest contributor to incremental electricity supply. ICIS expect gas power demand to grow by 6% yoy in the coming winter, as a result of the ongoing expansion in the installed capacity.

China 2023 year-to-date electricity output increase by May

Source: China Electricity Council, ICIS Analytics