In a bid to align with the obligation of the 2015 Paris Agreement to limit global warming to well below 2 Degrees Celsius, ideally 1.5 Degrees compared to pre-industrialised levels, more and more countries are introducing strategies to reduce their national emissions of greenhouse gases (GHGs) over the coming decades. Moreover, the findings from the Sixth Assessment Report of the Intergovernmental Panel on Climate Change published in 2023, show that serious commitments in the reduction of GHGs need to be made as a matter of urgency to keep with the temperature limit. In the wake of the United Nations Framework Convention on Climate Change Conference of the Parties (COP28) that will take place in the United Arab Emirates in November 2023, several countries have enacted laws and policies that evidence their commitment to becoming carbon neutral. Examples include Sweden through the Climate Act, aiming for carbon neutrality by 2045; South Korea through the Carbon Neutral and Green Growth Basic Act, aiming for carbon neutrality by 2050 and Nigeria, aiming for carbon neutrality by 2060.

Interestingly, this also includes more and more low- and middle-income countries that still have trajectories of significant industrial and economic growth ahead of them. Therefore, the energy transition shift is not only a shift to decarbonize existing economies but also to enable industrialization and economic growth based on low-carbon technologies.

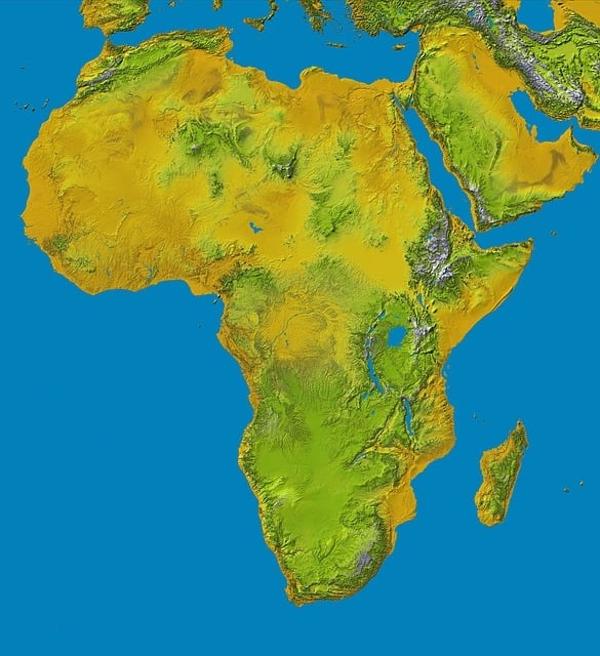

A substantial element of the transition towards carbon neutrality is the phasing out of fossil fuels and replacing these with renewable energies and green technologies. However, the move towards a low-carbon future will require vast quantities of minerals and metals. For instance, at least 16 different minerals or metals are needed to produce solar panels. Wind turbines and energy storage technologies equally require mineral and metal-intensive inputs. It is thus predicted that metals demand between 2021 and 2050 will likely double for wind and solar technologies, and even more for battery storage technologies. This strategically places Africa in a favorable position as access and availability of these minerals and metals are widely available in the region which boasts of large reserves of critical minerals such as platinum, manganese, cobalt, copper and bauxite. Access and availability of these minerals will increasingly determine the geopolitics of decarbonisation, where African states will potentially become important players. In order to fully seize this huge and global opportunity, there are three bottlenecks that need to be addressed.

First, until now the integration into global value chains for African countries has been very low and largely reduced to the export of raw materials. This has left them vulnerable to global price shocks of raw materials and has not generated much income, as African countries eventually need to buy the processed products for much higher costs. If Africa truly intends to benefit from the increasing demand of raw materials, it has to position itself higher up the value chain. This includes the creation of an enabling environment for foreign investments. This would also lead to the much-needed creation of jobs and economic growth along the entire value chain of processing minerals and metals. A positive example is the creation of a battery plant for e-vehicles that will be built in partnership between Zambia and the Democratic Republic of Congo. Additionally, Africa can maximise on the recent Critical Raw Materials Act by the European Union, which lists most minerals found in the region as critical for its transition.

Second, legislators need to be prepared to react to the new demand for minerals and metals by providing adequate oversight within the extractive industries. This includes the application of ESG (environmental, social and good governance standards) criteria and legislation that is specific to strategic minerals in their countries. This is because it is a governmental responsibility to assure that revenues from the increased demand for minerals and metals will be beneficial for the entire population, resulting in sustainable economic growth.

Third, the global volume of GHG emissions attributable to primary mineral and metal production is significant and the extractive sector is therefore required to reduce its emissions significantly by using the latest technologies and research available. It is evident that mining companies have to play a pivotal role in reducing the carbon footprint of mining operations and seek for low-carbon technologies. A good example is the Fortescue Company which aims to eliminate fossil fuel use across its iron ore operation by 2030. Many other companies are already using hydrogen-driven trucks on their mining sights. Serious commitments in the extractives sector to transition to green mining could therefore ensure a significant reduction of GHGs within the sector.

As the globe readies itself for COP28, it is pivotal to rethink Africa’s position in the critical minerals value chain. African countries can position themselves as important players in the ongoing global new order of energy. However, a good deal of work is still needed to fully tap into the opportunities that lay within. This requires joint efforts from the government and the private sector.

Anja Berretta is Head of the Regional Programme Energy Security and Climate Change for Sub-Saharan Africa for Konrad-Adenauer-Stiftung based in Nairobi, Kenya.