In October 2021, the world was thrust into a severe global energy crisis owing to the rapid economic rebound following the slowdown of the COVID-19 pandemic, the Russian invasion of Ukraine in 2022 and inflation, causing skyrocketing energy prices reaching their highest levels since 2008.

Amid this poly-crisis, renewable energy emerged as a ray of hope. Renewables were able to gain considerable momentum as energy consuming sectors became more reliant on renewable energy sources. The first publication of REN21’s Renewables Global Status Report collection titled, ‘Renewables in Energy Demand’ explores trends and opportunities for renewable energy deployment in all four demand sectors – buildings, industry, transport and agriculture.

Uptake in renewables

Energy-consuming sectors, shaken by the energy crisis, increasingly opted for renewable energy sources which are cheaper, more reliable, decentralised and equitable, shows the report.

In 2022, heat pump installations in buildings increased by a record 10% over 2021, especially in Europe where there was a 38% growth. This was due to households seeking more efficient and reliable heating options to replace fossil fuels. The market for cooling technologies is also changing rapidly in light of the increasing frequency of heatwaves, coupled with 1.2 billion people worldwide lacking access to cooling technologies.

In European industries, independent power purchase agreements (PPAs) became more popular, rising to a record 21% in 2022, with a growth rate six times higher than that of the renewable electricity capacity installed by national utilities. Despite this, state-owned energy providers are still not supportive of the transition to independent electricity sources, and unreliable grids mean that fossil fuel-powered backup systems are common.

As for the transport sector, investment in electric vehicles (EVs), including two and three-wheelers and buses, and their charging infrastructure is experienced rapid growth, with a 54% year-on-year increase, notably in Asia.

Renewable energy offered energy independence to rural farming communities in India and sub-Saharan Africa without access to electricity. Geothermal and bioenergy presented themselves as decentralised sustainable solutions for agriculture, while solar energy expanded to include cold storage and irrigation, providing reliable energy and income-generating opportunities.

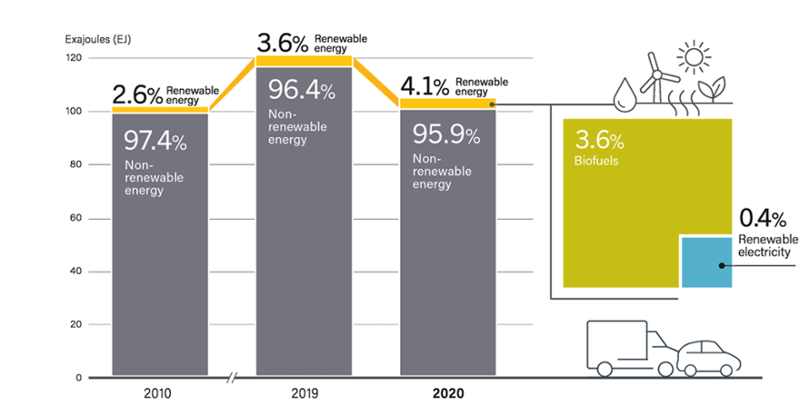

The share of renewables in these sectors grew at varying levels with transport responding the least even though it is the fastest growing in global energy consumption. The sector needs an “avoid-shift-improve” framework to achieve genuine sustainability and limit energy demand. Currently, renewables are not keeping pace with the rapid growth in energy demand for transport.

Renewable share of total final energy consumption in transport ( 2010, 2019, 2020)

Source: REN21, Renewable 2023 Global Status Report – Renewable in Energy Demand

Policy packages boosting renewables

“In many countries, governments sought alternative fossil fuel sources to restore disruptions to the energy supply or opted to heavily subsidise fossil fuels to shield consumers from price hikes; despite this, the uptake of renewables increased in all demand sectors,” the report reads.

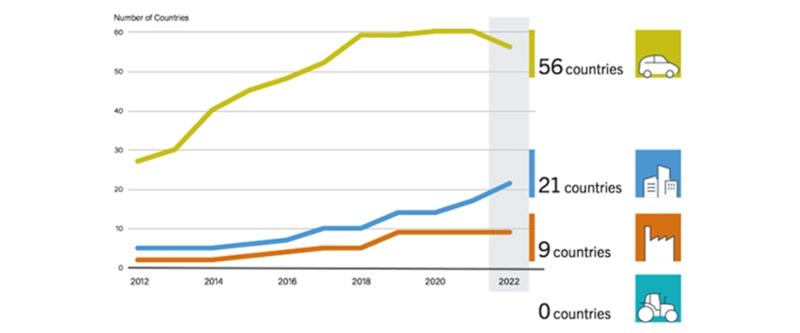

The report confirmed the high potential of policymaking on promoting renewables. Notable examples include the US Inflation Reduction Act, European Commission’s ‘REPowerEU’ plan, and India’s renewable hydrogen plans, which stimulated economic growth and boosted renewables uptake in buildings, industry, transport and agriculture.

Number of countries with renewable energy regulatory policies and mandates, by demand sector, 2012-2022

Souce: REN21, Renewable 2023 Global Status Report – Renewable in Energy Demand

However, the problem of governments sending mixed signals and continuing to spend on fossil fuel subsidies persists, disallowing renewables to compete on an even playing field. In fact, fossil fuel subsidies worldwide soared in 2022, rising above USD 1 trillion for the first time.

Fossil fuel dependency remains a major threat to energy security and access. LNG imports to European countries, including the UK, increased by 60% in 2022 compared to 2021. Meanwhile, the five largest oil companies– TotalEnergies, ExxonMobil, Chevron, BP and Shell – reported combined record profits of USD 153.5 billion in 2022.

A long way to go

Ramping up renewables, together with an aggressive energy efficiency strategy, is the most realistic path towards halving emissions by 2030. To meet the IPCC goal, annual investment in renewable power capacity will have to be three times the current rate of deployment (USD 0.5 trillion in 2022), as per the International Renewable Energy Agency.

A complete fossil fuel phase-out needs to go hand-in-hand with the energy transition. Domestic and industrial heat, industrial processes and the transport sector are still highly reliant on fossil fuels in most countries, contributing to emissions and perpetuating vulnerability to fluctuations in fossil fuel prices. Electrification, for example, of the transport sector is not enough. Electrification offers opportunities for transport to shift towards renewables like solar and wind, but all modes of transport must be decarbonised.

It’s clear as day -- energy-consuming consuming sectors cannot continue working in isolation and need to be brought into the conversation strategically to develop sectoral targets, policies and roadmaps.

Renewable energy has been evidenced as the solution to the current global energy crisis but if our goal is a secure, affordable, decentralised and accessible energy future for all, a rapid and complete shift to renewables needs to happen now.