Coal has long been a major part of the UK electricity mix. Over the last two decades, coal has provided a third of UK power. Over the last quarter, it provided just 1.3% of power, and many days this summer there was not a single coal power plant running anywhere in the UK. How did this remarkable transformation happen?

Three key policies drove the rapid transition away from coal:

- The Climate Change Act, which sets five yearly carbon budgets which the government must meet to bring down emissions.

- The UK carbon tax, which tops up the EU Emissions Trading System price by around €20.

- Remarkable and increasingly cheap renewables growth, which has given the government increasing confidence that the lights wouldn’t go out.

Added to this, there were few UK jobs left in coal mining following Prime Minister Margaret Thatcher’s forced closure programme in the 1980’s, and most coal was being imported from Russia and Columbia rather than domestically produced. This meant there was not as strong a constituency invested in coal as we’ve seen in other European countries such as Germany.

The UK coal phase-out was widely expected to involve a large, if temporary, switch to gas. When Amber Rudd, the Secretary of State, announced the UK coal phase-out back in 2015, she said: “in the next 10 years, it’s imperative that we get new gas-fired power stations built.”

This laid the ground for a new dash for gas: in the latest UK capacity market in February 2018, ten large gas plants with a capacity of 12GW applied for 15-year contracts, and a further five with a capacity of 10GW are readying themselves to apply in future auctions. This means almost half of all Europe’s prospective large gas plants are planned for the UK. However, so far, not a single one has bid successfully for a capacity contract. The growth in renewable power and interconnectors is rapidly undercutting the need for new gas. Our research shows the UK 2025 coal phase-out will likely be completed early, without building any large gas plants, and with a steady decline in the use of gas.

Most of the coal plant electricity capacity has already been replaced through the Capacity Market auctions. Contracts to replace five of the seven coal plants left last year have already been signed – with half the power coming from interconnectors, battery and Demand Side Response (DSR) – and the other half with backup fossil generation, mostly small peaking gas generators.

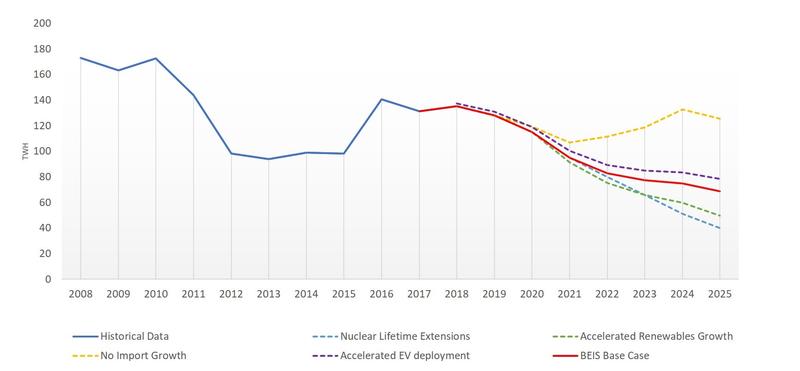

Much of this capacity will barely be used though. In 2017, gas use was already 24% below the peak set back in 2008. In the majority of the UK Government scenarios, which have conservative assumptions for renewables growth, gas use will be significantly lower in 2025 than it was in 2017. The Government’s Clean Growth Strategy published in 2017 envisages gas supplying just 15% of the UK’s electricity needs by 2032, down from 40% today. The rate of decline will be steepest in the early 2020s with gas’ share of the electricity mix projected to fall to just over 20% by 2025.

Even if electricity imports are lower than expected or demand is higher, the UK is still unlikely to need new gas plants – small distributed technology will fill the gap more cheaply. Faster renewables growth (particularly removing the effective ban on new UK onshore wind) and improved energy efficiency will mitigate these policy risks. Renewables auctions in 2017 suggest the cost of low-carbon power will continue to fall, with some UK offshore wind contracts now even below the price of new-build gas plants.

Gas demand outlook in different scenarios

Source: BEIS & Sandbag

The current ETS carbon price means coal plants across the EU have to pay more than €20 for every tonne of CO2 they emit. Alongside rising global fossil fuel prices, our research shows new onshore wind and solar can now compete with the short-term costs of generating electricity from existing coal and gas plants. In the UK, where carbon costs €40 a tonne, that economic divide is even more stark. Coal, and gas, will increasingly be outcompeted by UK low-carbon power, including renewables, energy storage, and nuclear.

The UK now looks set to leapfrog a ‘gas bridge’ to transition directly to clean power generation.