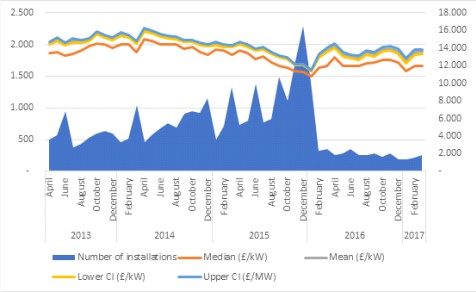

In the recent years, intermittent generation – most importantly solar photovoltaics and wind power – have undergone a remarkable transformation from niche technologies to increasingly competitive energy suppliers. Intermittent generation is blossoming in the UK, where renewable electricity capacity was 40.5 GW at the end of 2017, a 13.3% increase (4.8 GW) on a year earlier, largely due to increased wind (both onshore and offshore) and solar PV capacity. These trends are largely due to increased efficiency gains of Renewable Energy technologies that are becoming cheaper and more competitive under a greater variety of conditions across the country. As an example, over the course of the financial year 2017/18, the average cost per kW for 0-4kW solar PV installation was 1.4% lower than in 2016/17. The mean cost for 2017/18 is around 11.5% lower than in 2013/14 and 2014/15. Similar gains have been achieved for larger installations. However, incentive schemes still play a vital role in determining the level of RES penetration, at least for some technologies. Recent changes on the Feed in Tariff (FiT) scheme, a government programme designed to promote the uptake of renewable and low-carbon electricity generation technologies, has substantially halted the deployment of small (capacity up to 5MW) solar panel (fig. 1).

Figure 1 Small scale PV cost and Number of installation (0-4kW)

Source: Annual Cost of Small-Scale Solar Technology Summary available here

On the other hand the UK government has recently awarded three offshore wind projects with Contracts for Difference (CfD) in the second round of auctions with strike prices going as low as £ 57.50/MWh for projects scheduled for commissioning in 2022/23. This puts them among the cheapest new sources of electricity generation in the UK and close to the medium term wholesale electricity price projections: the Department for Business, Energy and Industrial Strategy (BEIS) expects wholesale power prices to average £53/MWh in the period from 2023 to 2035, covering the bulk of their 15-year contract period. The auction award a contract for difference, contracts that represent a new subsidy scheme that are paid as a fixed “strike price” and most of them last for 15 years. During the contract period, projects are paid the difference between a reference wholesale price and their strike price. If wholesale prices rise above the strike price, the project pays back the difference. CfDs provides guaranteed income that allow developers to get more favourable terms from investors and that cuts the cost of borrowing, which makes up a large part of the total price tag for low-carbon generation.

Whereas wind generation is often cheaper than traditional technologies, it is often sited in remote locations and requires to be connected to the transmission and distribution grids. In order to do so Ofgem (the gas and electricity regulatory authority in the UK), introduced an innovative new licensing model, combining aspects of both competition and regulation, to deliver offshore electricity transmission infrastructure in Great Britain. Unlike in other jurisdictions, this involves a competitive tender process to appoint new offshore electricity network operators who have the responsibility for operating newly constructed electricity transmission network assets, which connect offshore electricity generation (wind farms) to the shore.

The deployment of low carbon electricity generation, in general, poses important challenges on how costs associated with the penetration of these emerging generation technologies are assessed and distributed among the different stakeholders, that might now have very different generation (consumption) profiles and costs. In particular two trends are emerging across Europe: a steady decrease of the energy cost coupled with an increase in the system costs associated with cheaper energy generation.

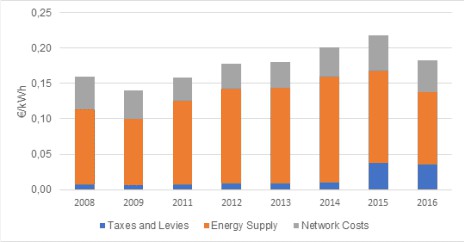

A recent report shows that in the European Union, the cost of network services for households have been increasing in recent years: the average household price for electricity in 2015 was € 208.7 MWh, with an average annual increase of 3.2 % between 2008 and 2015 [1]. In the same period the cost of energy declined by 15%, whereas network charges – which accounted for just over a quarter (or 54 €/MWh) of the bill – grew by 3.3% on average per year. Additionally, charges connected to renewable electricity and combined heat and power provision grew significantly, accounting for 33% of the total bill in 2015, up from 14% in 2008. Notwithstanding declining wholesale electricity prices, network charges and renewable electricity support schemes have contributed to push the average bill up, and a similar trend is emerging in the UK (Fig.2).

Figure 2 - Break down of Retail price for households in UK

(Band DC : 2 500 kWh < Consumption < 5 000 kWh)

Author reproduction based on Data from: Electricity prices components for non-household consumers - annual data (from 2007 onwards) (nrg_pc_205_c) available here: http://ec.europa.eu/eurostat

Therefore, UK energy system is experiencing a growing trend where Renewable Energy generation benefit from public interventions that support investment mostly in small-scale domestic solar PV installation while at the same time electricity (competitively) generated from large wind farms might contribute to cause greater system costs, by increasing overall network charges.

There is a growing concern that a switch away from fossil fuels and the increased penetration of low carbon technologies will not only have a significant cost to customers and energy users, but could affect the investment capacity of market operators in relation to electricity networks and even undermine their dynamic efficiency if investors were burdened with worthless investments. In this framework it is important to explore what impact would a low-carbon transition have on existing and future electricity networks in the UK and the general regulatory framework that has been traditionally adopted to remunerate those assets.

To limit the unbalanced burden on traditional consumers - those less able, for economic, social and demographic reasons, to adapt their behaviours and/or to invest in new appliances that can respond effectively to the new price signals - many countries are introducing tariffs with a greater proportion of fixed component [2], which may also include capacity charging. On average 31% of network tariffs in 19 European countries, rely on fixed components, with the Netherlands representing an extreme case adopting a full fixed tariff, independent of energy consumption. In the United Kingdom, Ofgem recently began a Targeted Charging Review [3] and is currently evaluating changes to existing network charges that increasingly fall on those network users who are not able to adjust the timing and volume of their consumption of electricity. On the other hand, the increased contestability in offshore transmission network has driven down operating costs and the cost of equity for network assets. The Offshore Transmission Owner (OFTO) approach offers lessons for structuring other contestable infrastructure opportunities. There may be other instances where such a set of circumstances would allow a similar approach, which would similarly deliver benefits. Ofgem, for example, is currently considering the extension of a contestable tender model to apply to onshore electricity transmission assets of sufficient scale and appropriate scope.

In general the new energy paradigm requires a better application of the polluter pay principle for system costs, in order to avoid excessive penalisation of captive consumers. It also requires the introduction of greater contestability and stronger competitive pressures in order to allow the most efficient solutions to emerge in the market. This process however reminds us that technological innovation will continuously pose new challenges to existing regulatory frameworks, and that horizon scanning and innovation in regulation is as important as regulating innovation in modern energy systems.

References

[1] Energy prices and costs in Europe, Report from the commission to the european parliament, the Council, the european economic and social committee and the Committee of the regions, (2016), Brussels, 30.11.2016 COM(2016) 769 final

[2] REFe - Study on tariff design for distribution systems, Final Report Prepared for: DIRECTORATE‐GENERAL FOR ENERGY DIRECTORATE B – Internal Energy Market, 2015 available here: https://ec.europa.eu/energy/en/studies/study-tariff-design-distribution-systems

[3] Targeted Charging Review 4th August 2017 https://www.ofgem.gov.uk/publications-and-updates/targeted-charging-review-significant-code-review-launch